What is Household Budget Spreadsheet?

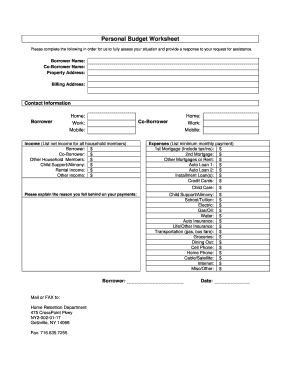

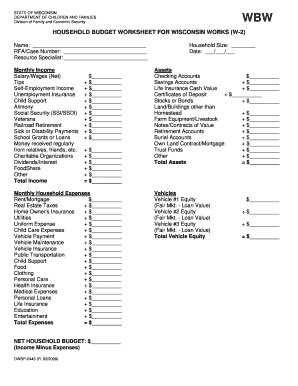

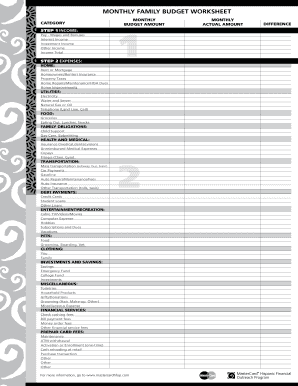

A Household Budget Spreadsheet is a tool that helps individuals and families to manage and track their finances. It is a digital document, typically created in a spreadsheet format, that allows users to input their income, expenses, and savings goals. The spreadsheet automatically calculates totals, provides visual representations of spending patterns, and helps users make informed financial decisions.

What are the types of Household Budget Spreadsheet?

There are various types of Household Budget Spreadsheets available to cater to different user needs. Some common types include:

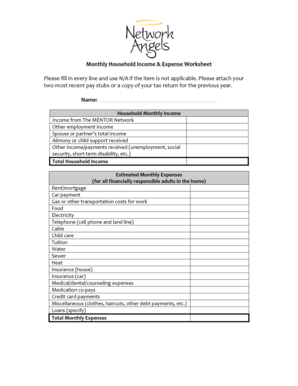

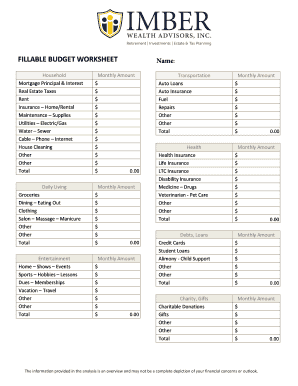

Basic Budget Spreadsheet: This type focuses on essential income, expenses, and savings categories.

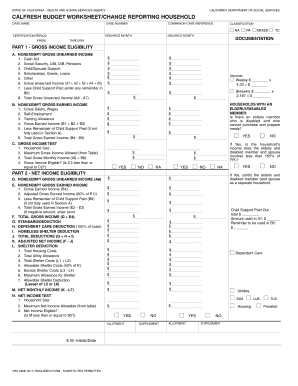

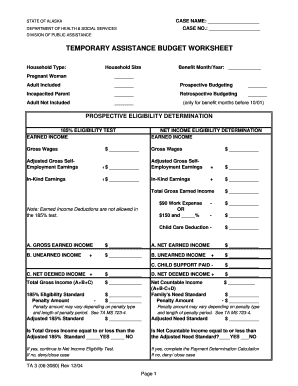

Detailed Budget Spreadsheet: This type provides a more comprehensive breakdown of income sources and expenditure categories.

Zero-based Budget Spreadsheet: This type requires users to allocate every dollar of income to different expense categories, ensuring a balanced budget.

Envelope Budget Spreadsheet: This type involves allocating cash amounts to different envelopes representing different expense categories for a visual representation of spending limits.

How to complete Household Budget Spreadsheet

Completing a Household Budget Spreadsheet is a straightforward process. Here are the steps to get started:

01

Gather financial information: Collect all your income sources, expenses, and savings goals.

02

Set up the spreadsheet: Create a new and empty spreadsheet or use a pre-designed template.

03

Input income details: Enter your income sources, such as salaries, investments, or side hustles.

04

Add expense categories: Define the different categories for your expenses, such as rent, utilities, groceries, and entertainment.

05

Input amounts: Enter the amounts for each income source and expense category.

06

Review and analyze: Once all the information is inputted, review the calculations and analyze the data to identify areas for improvement or adjustment.

07

Make adjustments: Based on the analysis, make adjustments to your budget by reallocating funds or cutting down certain expenses.

08

Track regularly: Continuously update the spreadsheet with your actual income and expenses to keep track of your financial progress.

09

Utilize pdfFiller: To simplify the process of creating and editing budget spreadsheets, consider using pdfFiller. It empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

By following these steps and utilizing the right tools, you can ensure accurate and effective budgeting using a Household Budget Spreadsheet.