Housing Benefit Form - Page 2

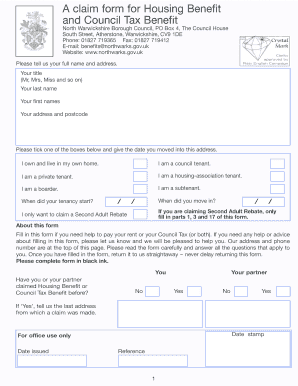

What is Housing Benefit Form?

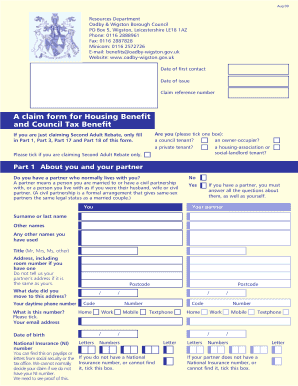

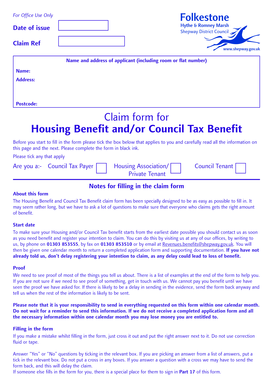

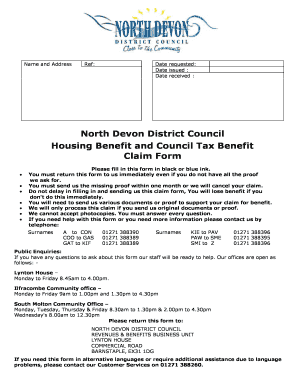

The Housing Benefit Form is a document that individuals can fill out to apply for financial assistance with their housing costs. This form is typically used by individuals who are on a low income or are unemployed and need help paying their rent.

What are the types of Housing Benefit Form?

There are several types of Housing Benefit Forms that individuals may need to complete depending on their specific circumstances. Some common types include:

Housing Benefit Form - for individuals who rent a property from a private landlord.

Housing Benefit Form (Social tenancy) - for individuals who rent a property from a local council or housing association.

Housing Benefit Form (Temporary accommodation) - for individuals who are temporarily housed by a local council.

Housing Benefit Form (Board and lodging) - for individuals who live in accommodation such as a bed and breakfast.

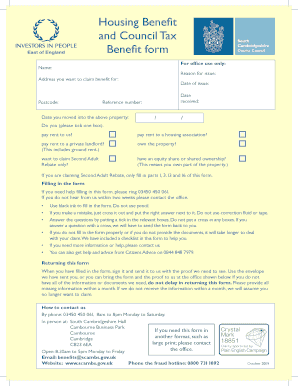

How to complete Housing Benefit Form

Completing the Housing Benefit Form is a straightforward process. Here are the steps you need to follow:

01

Provide personal information, including your name, address, and contact details.

02

Enter details about your current housing situation, such as the address of the property you rent and the name of your landlord.

03

Provide information about your income, including details of any benefits or allowances you receive.

04

Include details of any other people living in your household, such as your spouse or children.

05

Sign and date the form to confirm that the information you have provided is accurate.

By using pdfFiller, you can easily complete the Housing Benefit Form online. With unlimited fillable templates and powerful editing tools, pdfFiller makes it simple to create, edit, and share your documents securely.

Video Tutorial How to Fill Out Housing Benefit Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How often does Universal Credit get reviewed?

1. Assessment period. Universal Credit is assessed and paid in arrears, on a monthly basis in a single payment. Your personal circumstances will be assessed to work out the amount of Universal Credit you are entitled to.

Do you get full Housing Benefit on Universal Credit?

If you pay rent to a local authority, council or housing association you will get your full rent as part of your Universal Credit payment. This will be reduced by 14% if you have one spare bedroom, or 25% if you have 2 or more spare bedrooms. This is known as Removal of the Spare Room Subsidy.

Are Housing Benefit reviews random?

It's a review form (known as an intervention). You've been randomly selected by the computer. Thousands of people have received them.

How much money can you have in the bank and still claim housing benefits UK?

Housing Benefit and Council Tax Support These benefits have a lower capital limit of £6,000 and an upper capital limit of £16,000. If you have less than £6,000 of capital then you should be able to claim the full benefit.

Why have I been sent a Housing Benefit review form?

If you're in receipt of Housing Benefit and/or Council Tax Support we may review your claim from time to time. This is to ensure that your claim details are up to date, and you're getting the correct entitlement.

How much savings can I have on Housing Benefit?

Usually, you will not get Housing Benefit if: your savings are over £16,000 - unless you get Guarantee Credit of Pension Credit. you're paying a mortgage on your own home - you may be able to get Support for Mortgage Interest (SMI) you live in the home of a close relative.

Related templates