How Does Lease With Option To Buy A House Work

Video Tutorial How to Fill Out how does lease with option to buy a house work

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Which of the following is a disadvantage of a lease purchase deal?

Of course, the biggest disadvantage is that lease purchase agreements are multi-year contracts. This carries a certain degree of risk and uncertainty that many sellers may choose to avoid.

How does a lease option work in Florida?

Lease Option to Purchase A contract in which a landlord/seller leases his or her property to a tenant/buyer for a specific monthly rent, and which gives the tenant the right (but not the obligation) to buy the property at or before the end of the lease period for a price established in advance.

What is the benefit of a lease option?

Unlike a sale agreement with seller financing, a lease-option allows the owner to continue to receive tax deductions as the owner. Interest, taxes, maintenance and depreciation may still be deducted against the rent received.

What does a 5 year lease with a 5 year option mean?

So, a 5 year lease with a 5 year renewal option is a 10 year commitment by the landlord. This limits the value of the property to a market cap rate applied to existing rental income, which is often less than the value of a vacant building sold to an owner/user buyer.

How do you write a rent to own proposal?

Your proposal should detail the amount of the non-refundable option fee and rental credits, as well as the price you are offering for the home. Next, propose a new lease to cover the rental period, which is typically one to three years. It is at the end of the lease that you expect to be in a position to buy the house.

Is lease with option to buy a good idea?

A lease-option-to-buy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.

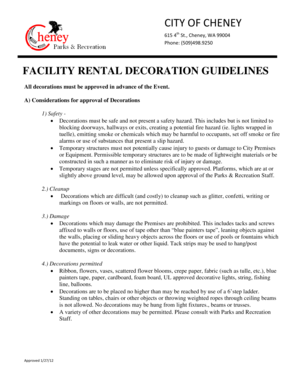

Related templates