How To Calculate Bonus Depreciation 2015

What is how to calculate bonus depreciation 2015?

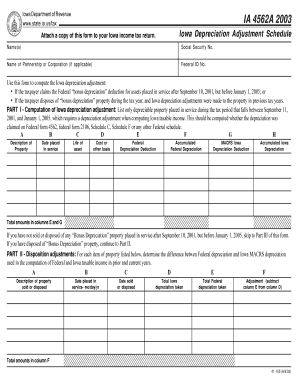

To calculate bonus depreciation for the year 2015, you need to consider the specific guidelines provided by the tax authorities. Bonus depreciation allows businesses to deduct a larger percentage of the cost of qualifying assets in the year they are placed in service. It is important to consult with a professional tax advisor or refer to the official documentation to ensure accurate calculation.

What are the types of how to calculate bonus depreciation 2015?

There are two types of bonus depreciation methods commonly used in calculating bonus depreciation in 2015: 1. Regular depreciation method: This method applies the standard depreciation rules and allows you to deduct a portion of the asset's cost over its useful life as determined by the tax regulations. 2. Section 179 deduction: This method allows you to expense a particular amount of the asset's cost in the year it was placed in service, subject to certain limits set by the tax authorities.

How to complete how to calculate bonus depreciation 2015

To complete the calculation of bonus depreciation for the year 2015, follow these steps: 1. Determine the cost of the qualifying asset(s) that were placed in service during the year. 2. Choose the appropriate bonus depreciation method: either the regular depreciation method or the Section 179 deduction method. 3. Apply the chosen method to calculate the bonus depreciation amount for each asset. 4. Keep accurate records of the calculations and documentation for future reference or tax purposes.

pdfFiller empowers users to effortlessly create, edit, and share their documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor for all your document needs.