What is how to prepare a financial budget for a company?

Preparing a financial budget for a company is the process of estimating and planning the inflows and outflows of money for a specific period. It involves setting financial goals, forecasting revenues and expenses, and identifying potential financial risks. By creating a comprehensive budget, companies can make informed decisions, allocate resources effectively, and measure their financial performance.

What are the types of how to prepare a financial budget for a company?

There are several types of budgets that companies can prepare to manage their finances effectively. These include:

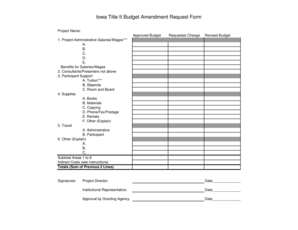

Operating Budget: This budget focuses on the day-to-day operations of the company and includes expenses related to sales, marketing, production, and administration.

Capital Budget: This budget is used to plan and allocate funds for long-term investments such as purchasing assets, equipment, or property.

Cash Budget: This budget forecasts the cash inflows and outflows of the company to ensure it has sufficient liquidity to meet its financial obligations.

Sales Budget: This budget sets revenue targets and outlines the expected sales volume and prices for the products or services offered by the company.

Expense Budget: This budget tracks and controls the company's expenses by allocating funds to different cost categories such as salaries, utilities, and supplies.

How to complete how to prepare a financial budget for a company

To complete a financial budget for a company, follow these steps:

01

Gather Financial Data: Collect all relevant financial information, including historical revenue and expense records, market research data, and industry benchmarks.

02

Identify Financial Goals: Determine the company's short-term and long-term financial objectives, such as increasing profitability, reducing costs, or expanding market share.

03

Forecast Revenue: Analyze market trends, customer behavior, and sales patterns to estimate future revenues for the budget period.

04

Estimate Expenses: Project the company's expected expenses based on historical data, industry benchmarks, and anticipated changes in costs.

05

Allocate Resources: Allocate resources to different departments or cost centers based on their expected needs and priorities.

06

Create a Budget Report: Summarize the budgeted revenue, expenses, and net income in a budget report that can be used for analysis and decision-making.

07

Review and Revise: Regularly review the budget and compare actual results to the budgeted amounts. Make necessary adjustments and revisions to reflect changing circumstances.

08

Utilize pdfFiller: Empower your budgeting process with pdfFiller's online document solution, which offers unlimited fillable templates and powerful editing tools. By using pdfFiller, you can streamline your budgeting process and collaborate with team members more efficiently.

09

Monitor Financial Performance: Continuously monitor the company's financial performance against the budget to identify any variances or deviations. Take corrective actions if needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.