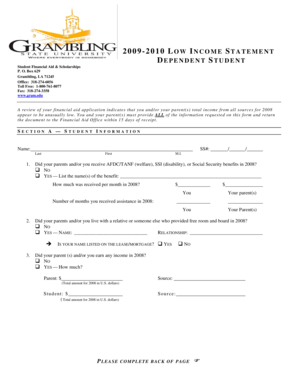

How To Prepare An Income Statement

Video Tutorial How to Fill Out how to prepare an income statement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 4 four key of financial statement?

There are four main financial statements. They are: (1) balance sheets. (2) income statements. (3) cash flow statements. and (4) statements of shareholders' equity.

How do I create an income statement in Excel?

To make your Income Statement, first, open up Microsoft Excel, then create a new file. In the first cell, type in [Company Name] Income Statement. This helps you organize your files, especially if you need to print this document. Skip one row and then write Covered Period.

Does Excel have a income statement template?

You can download your free income statement template in the format that suits you best. If you like using spreadsheets, you can use the free Microsoft Excel or Google Sheets invoice statement to get started. With the free income statement excel template, you'll gain access to a helpful income statement formula.

What are the main 4 components of income statements?

The income statement focuses on four key items: revenue, expenses, gains, and losses.

How do I make an income statement template?

How to Write an Income Statement Pick a Reporting Period. Generate a Trial Balance Report. Calculate Your Revenue. Determine Cost of Goods Sold. Calculate the Gross Margin. Include Operating Expenses. Calculate Your Income. Include Income Taxes.

What are the 4 steps to prepare an income statement?

How to prepare an income statement Step 1: Print the Trial Balance. Step 2: Determine the Revenue Amount. Step 3: Determine the Cost of Goods Sold Amount. Step 4: Calculate the Gross Margin. Step 5: Determine Operating Expenses. Step 6: Calculate Income. Step 7: Calculate the Income Tax. Step 8: Calculate Net Income.

Related templates