How To Set Up Direct Deposit For Employees

What is how to set up direct deposit for employees?

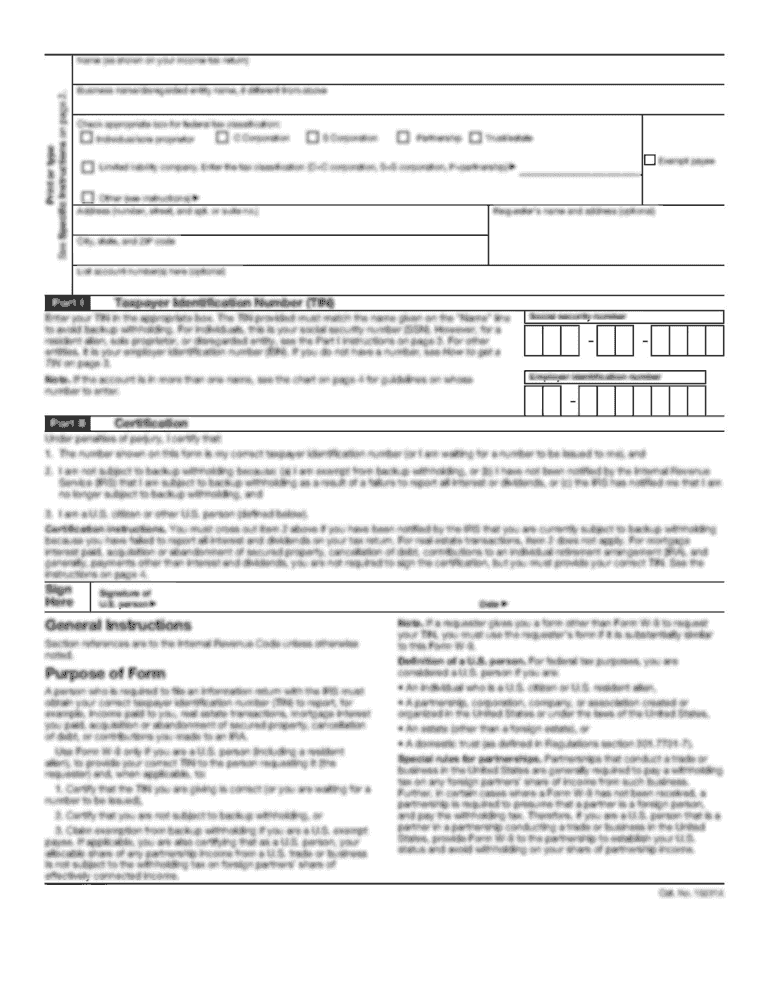

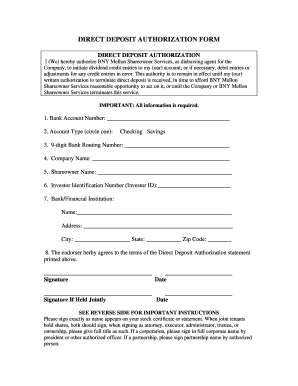

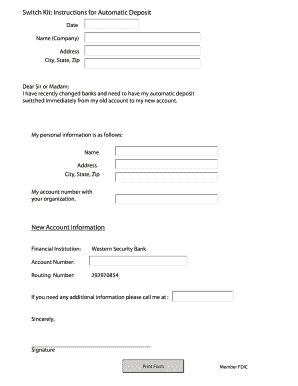

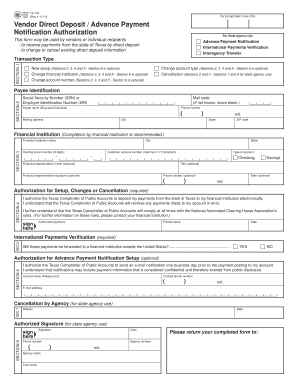

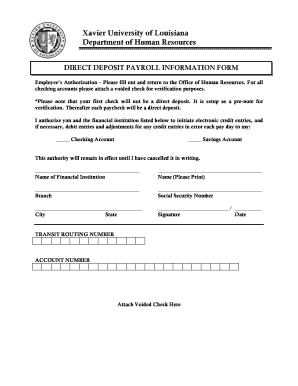

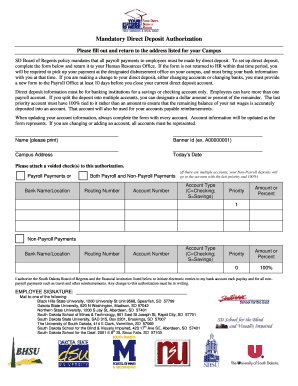

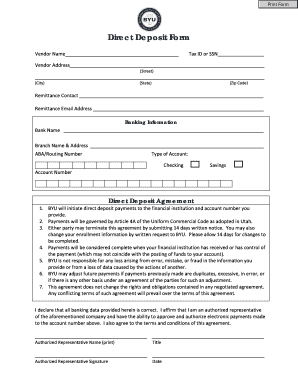

Direct deposit is a convenient and secure method for businesses to pay their employees. It allows employers to electronically deposit employees' paychecks directly into their bank accounts, eliminating the need for paper checks. This not only saves time but also reduces the risk of lost or stolen checks.

What are the types of how to set up direct deposit for employees?

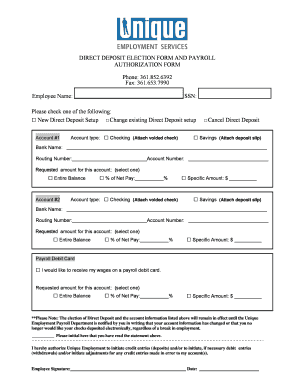

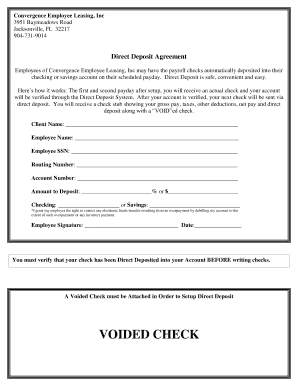

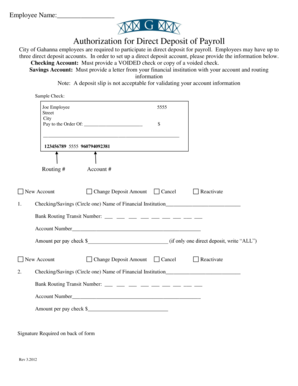

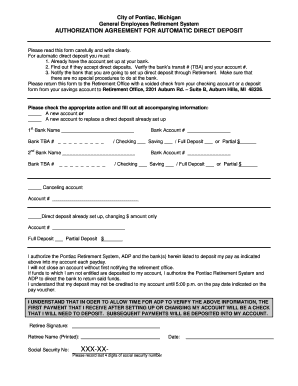

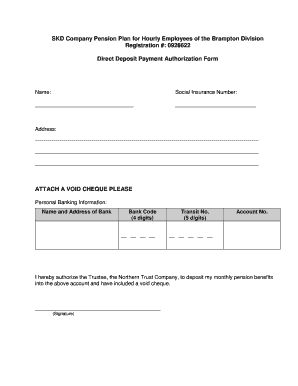

There are two types of direct deposit setups for employees: 1. Employer-Initiated Direct Deposit: In this setup, the employer takes the initiative to set up direct deposit for their employees. They collect the necessary bank account information from each employee and handle the setup process. 2. Employee-Initiated Direct Deposit: In this setup, employees take the responsibility to set up direct deposit themselves. They provide their bank account details to the employer, who then facilitates the setup process.

How to complete how to set up direct deposit for employees

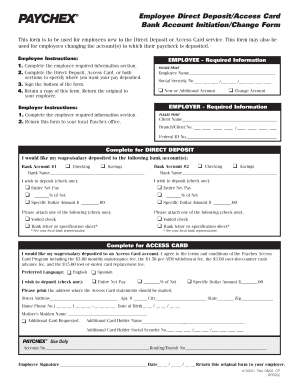

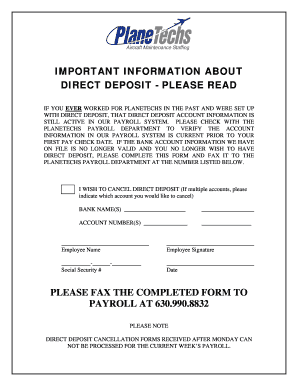

To complete the setup process of direct deposit for employees, follow these steps: 1. Gather necessary information: Collect the employee's bank account details such as bank name, account number, and routing number. 2. Obtain authorization: Ensure that the employee provides written consent to set up direct deposit and comply with any legal requirements. 3. Choose a direct deposit provider: Select a reliable direct deposit provider, such as pdfFiller, which offers unlimited fillable templates and powerful editing tools to simplify the process. 4. Set up direct deposit: Enter the employee's bank account information into the chosen direct deposit provider's system and follow their instructions for completing the setup. 5. Test the process: Conduct a test transaction with a small amount to verify that the direct deposit setup is functioning correctly. 6. Communicate with employees: Inform employees about the successful setup of direct deposit and provide them with any necessary instructions or resources.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.