How To Sign Up For Medicare At Age 65

What is how to sign up for medicare at age 65?

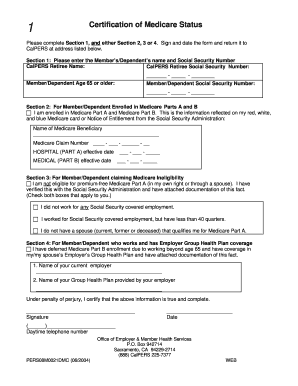

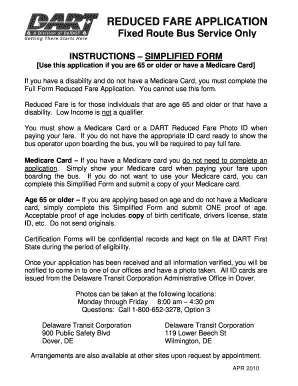

Signing up for Medicare at age 65 is an important step towards ensuring your healthcare needs are covered as you enter your golden years. Medicare is a federal health insurance program that provides coverage for individuals who are 65 and older, as well as for certain younger individuals with disabilities. It's designed to help you afford medical expenses, including hospital stays, doctor visits, and prescription drugs. To sign up for Medicare at age 65, you'll need to follow a few simple steps to ensure you enroll in the right plan and receive the coverage you need.

What are the types of how to sign up for medicare at age 65?

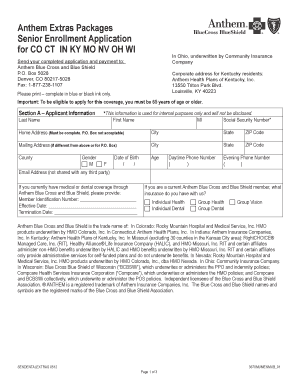

There are several types of Medicare plans you can choose from when signing up for coverage at age 65. These include: 1. Original Medicare (Part A and Part B): This is the traditional fee-for-service plan offered by the federal government. It provides coverage for hospital stays (Part A) and medical services (Part B). 2. Medicare Advantage (Part C): These are private insurance plans that combine the coverage of Parts A and B, and often include additional benefits such as prescription drug coverage and wellness programs. 3. Prescription Drug Plans (Part D): These plans are designed to help cover the cost of prescription medications and can be added to Original Medicare or Medicare Advantage plans. 4. Medicare Supplement Insurance (Medigap): These policies can help cover some of the out-of-pocket costs that Original Medicare doesn't pay for, such as deductibles, copayments, and coinsurance.

How to complete how to sign up for medicare at age 65

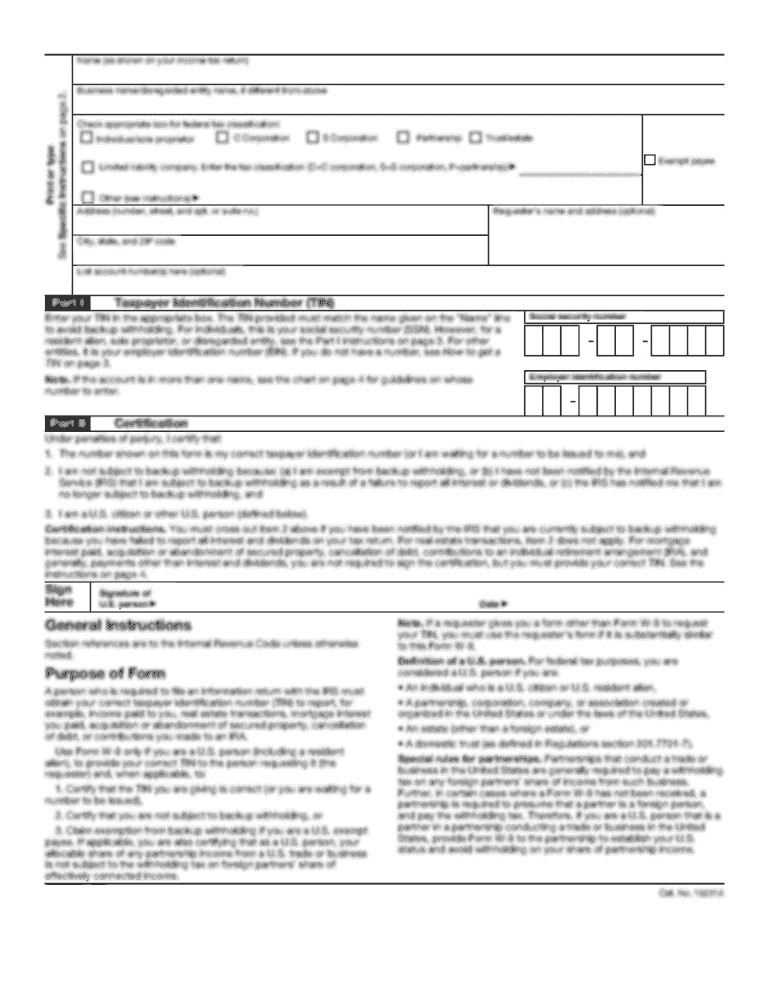

To complete the sign-up process for Medicare at age 65, follow these steps: 1. Gather necessary information: Before enrolling, make sure you have your Social Security number, proof of U.S. citizenship or legal residency, and details about your current health insurance coverage, if applicable. 2. Determine your eligibility: Confirm that you meet the age and residency requirements for Medicare coverage. 3. Choose a Medicare plan: Research and compare the different types of Medicare plans listed above to determine which one best suits your healthcare needs and budget. 4. Enroll in a plan: Once you've chosen a plan, you can apply online through the official Medicare website or by phone. You can also visit your local Social Security office to complete the enrollment process in person. 5. Understand enrollment periods: Make sure you're aware of the various enrollment periods and deadlines to avoid any gaps in coverage. 6. Review and update your plan annually: It's important to review your Medicare plan each year during the Annual Enrollment Period (AEP) to ensure it still meets your needs and to make any necessary changes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.