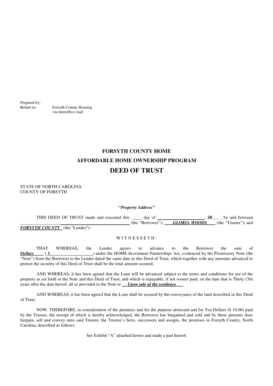

How To Write A Deed Of Trust

What is how to write a deed of trust?

A deed of trust is a legal document that outlines the terms and conditions of a loan agreement, specifically the transfer of ownership of a property as collateral for the loan. It is commonly used in real estate transactions where a borrower pledges their property as security for a loan. Writing a deed of trust requires careful consideration of the terms and language used to ensure its validity and enforceability. It is important to consult with a legal professional or use a trusted document editor like pdfFiller to ensure accuracy and compliance with local laws and regulations.

What are the types of how to write a deed of trust?

There are several types of deeds of trust, each serving a specific purpose. Some common types include: 1. Standard Deed of Trust: This is the most common type of deed of trust used in real estate transactions. It outlines the rights and responsibilities of both the borrower and the lender. 2. Deed of Trust with Assignment of Rents: This type of deed of trust allows the lender to collect rental income from the property in the event of default. 3. Deed of Trust with Power of Sale: This type of deed of trust grants the lender the power to sell the property in the event of default, without going through a court process. 4. Deed of Trust Involving Multiple Properties: This type of deed of trust is used when multiple properties are being used as collateral for a loan. It is important to understand the specific type of deed of trust needed for your situation and consult with a legal professional if necessary.

How to complete how to write a deed of trust

Completing a deed of trust involves several steps to ensure its accuracy and validity. Here is a general guide to help you: 1. Identify the parties involved: Include the names and addresses of the borrower (also known as the trustor), the lender (also known as the beneficiary), and the trustee. 2. Describe the property: Provide a detailed description of the property being used as collateral, including its address and legal description. 3. Specify the terms of the loan: Outline the amount of the loan, the interest rate, repayment terms, and any penalties for default. 4. Include any additional provisions: Include any additional clauses or provisions that are specific to your agreement, such as insurance requirements or dispute resolution procedures. 5. Sign and notarize the document: Both the borrower and the lender must sign the deed of trust, and it may need to be notarized depending on local laws. Remember to consult with a legal professional or use a trusted document editor like pdfFiller to ensure compliance with local laws and regulations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. Whether you're writing a deed of trust or any other legal document, pdfFiller provides a user-friendly platform that ensures accuracy and compliance with local laws. Try pdfFiller today and experience the convenience of online document editing.