How To Write A Loan Agreement

What is how to write a loan agreement?

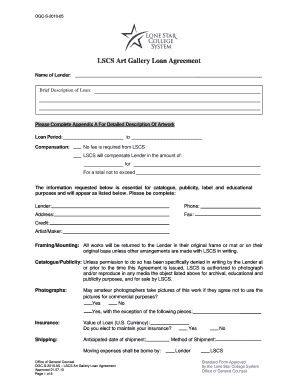

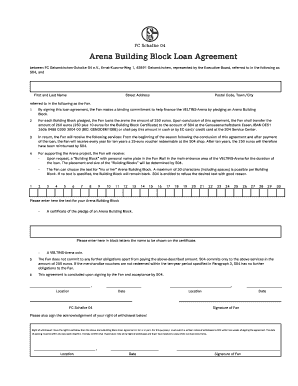

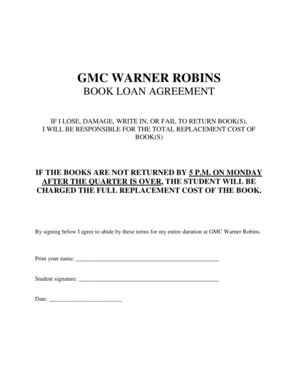

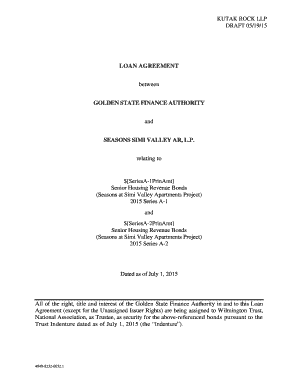

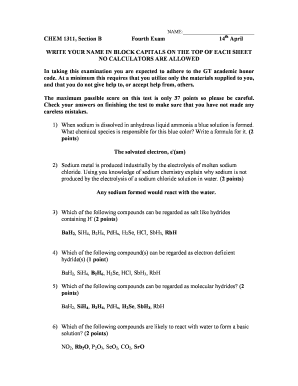

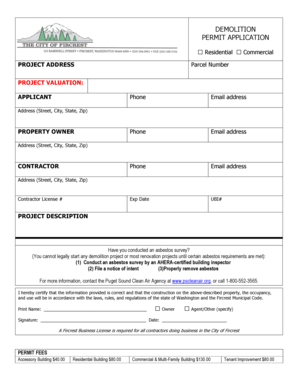

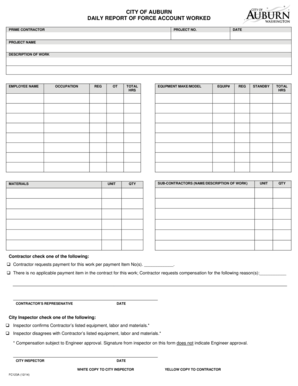

A loan agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It is important to write a loan agreement to ensure that both parties understand and agree to the terms of the loan. In the agreement, you should include details such as the loan amount, interest rate, repayment schedule, and any collateral or guarantees. By having a written loan agreement, you can protect your rights and avoid any misunderstandings or disputes in the future.

What are the types of how to write a loan agreement?

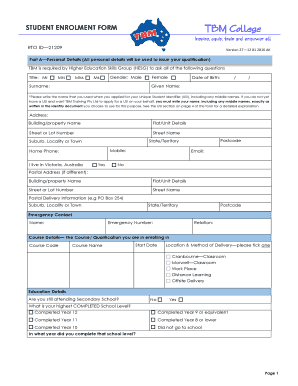

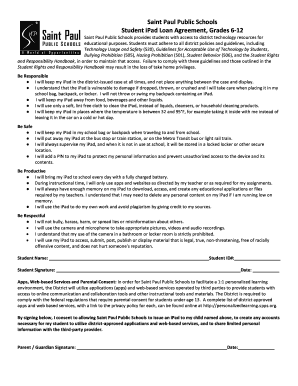

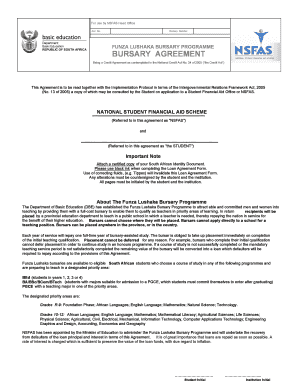

There are different types of loan agreements depending on the purpose of the loan and the parties involved. Some common types include: 1. Personal Loan Agreement: Used for loans between individuals. 2. Business Loan Agreement: Used for loans between a business and a lender. 3. Mortgage Loan Agreement: Used for loans for the purchase of real estate. 4. Student Loan Agreement: Used for loans for education expenses. 5. Auto Loan Agreement: Used for loans to finance the purchase of a vehicle. Each type of loan agreement may have specific requirements and terms that should be considered when writing the agreement. It is important to understand the specific type of loan agreement you need before drafting one.

How to complete how to write a loan agreement

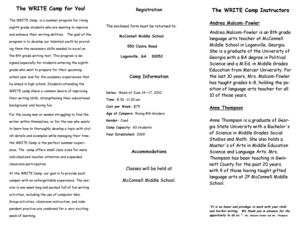

When completing a loan agreement, there are several important steps to follow: 1. Gather all necessary information: Collect all the relevant details about the loan, including the loan amount, interest rate, repayment terms, and any collateral or guarantees. 2. Use a template or create a document: You can use a loan agreement template or draft the document from scratch. pdfFiller is a great tool that empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. 3. Include all essential terms: Make sure to include all the important terms in the agreement, such as the names of the parties involved, the loan amount, interest rate, repayment schedule, and any applicable fees or penalties. 4. Review and revise: Carefully review the loan agreement to ensure that all the terms and conditions are accurately stated and reflect the agreement between the parties. 5. Sign and notarize: Once both parties are satisfied with the loan agreement, sign it and consider getting it notarized to add an extra layer of authenticity and enforceability.

By following these steps, you can effectively complete a loan agreement and ensure that all parties involved are clear on the terms of the loan. Remember, using a reliable tool like pdfFiller can greatly simplify the process and provide you with the necessary resources to create a professional and legally binding loan agreement.