Id Theft Affidavit - Page 2

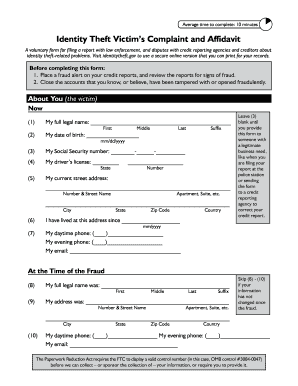

What is Id Theft Affidavit?

An Identity Theft Affidavit is a document that is used to report and resolve issues related to identity theft. It is a critical tool for victims of identity theft as it provides a formal record of the fraudulent activities and helps in the process of restoring their identity.

What are the types of Id Theft Affidavit?

There are mainly two types of Identity Theft Affidavits: the IRS Identity Theft Affidavit and the Federal Trade Commission (FTC) Identity Theft Affidavit. The IRS Identity Theft Affidavit is used to report fraudulent activities related to tax-related identity theft. On the other hand, the FTC Identity Theft Affidavit is more comprehensive and can be used to report various types of identity theft, such as credit card fraud, employment-related fraud, and government document-related fraud.

How to complete Id Theft Affidavit

Completing an Identity Theft Affidavit requires careful attention to detail. Here is a step-by-step guide to help you:

pdfFiller is an online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for users to get their documents done efficiently and securely.