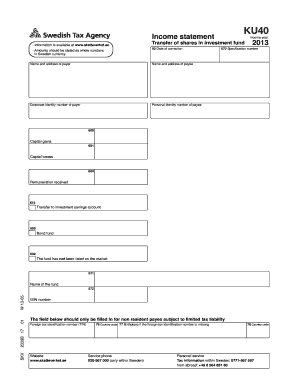

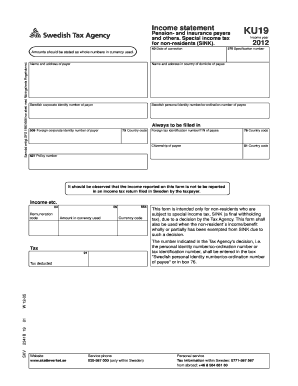

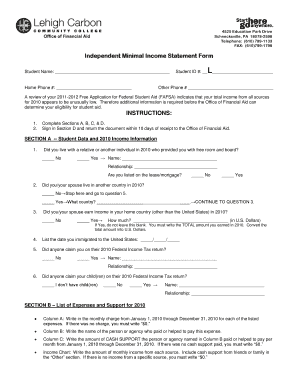

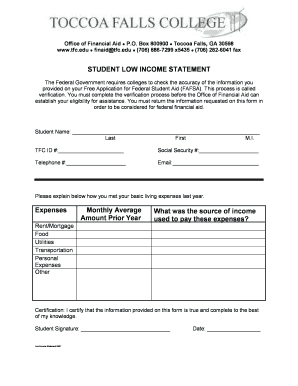

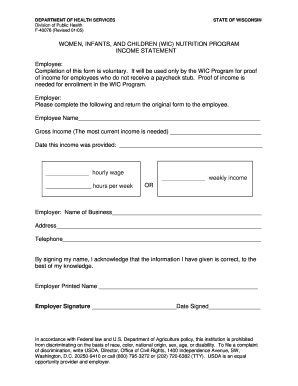

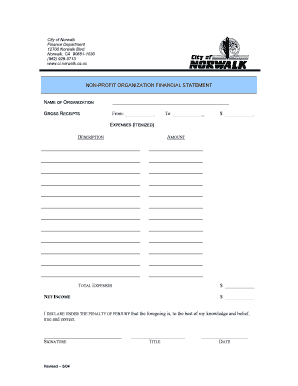

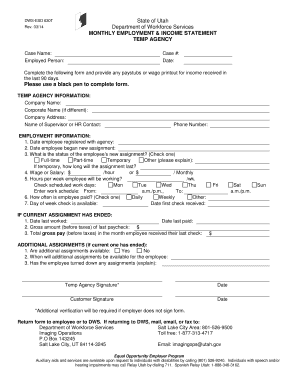

What is Income Statement?

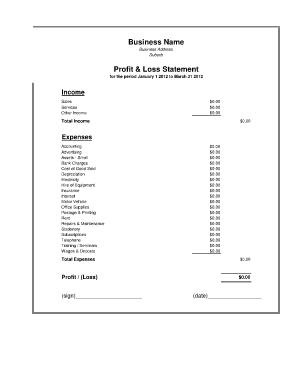

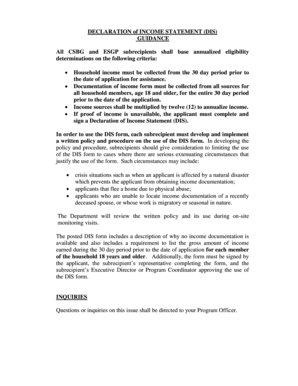

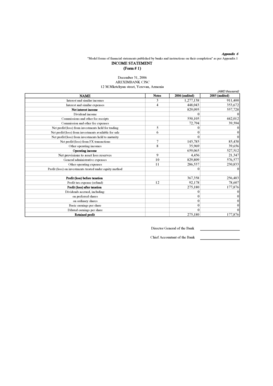

An Income Statement, also known as a Profit and Loss Statement, is a financial report that summarizes a company's revenues, expenses, and net income over a specific period. It provides valuable insights into a company's financial performance and helps assess its profitability.

What are the types of Income Statement?

There are several types of Income Statements that companies use to present their financial information. These types include:

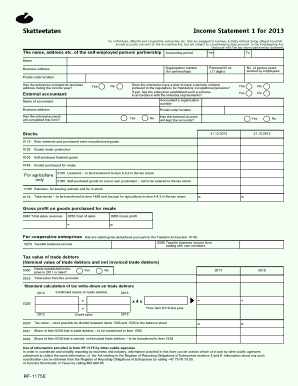

Single-Step Income Statement: This type of statement calculates the net income by subtracting all expenses from the total revenues in a single step.

Multi-Step Income Statement: This type of statement includes multiple steps to calculate the net income, focusing on various sources of revenue and different categories of expenses.

Consolidated Income Statement: This type of statement combines the financial information of a parent company and its subsidiaries to provide a comprehensive view of the overall financial performance.

How to complete Income Statement

Completing an Income Statement involves several key steps. Here is a step-by-step guide to help you complete an Income Statement:

01

Gather Financial Data: Collect all the necessary financial data, including revenues and expenses, from various sources.

02

Categorize Revenues and Expenses: Categorize the revenues and expenses into appropriate sections, such as sales, operating expenses, and non-operating expenses.

03

Calculate Net Income: Subtract the total expenses from the total revenues to calculate the net income.

04

Review and Analyze: Review the completed Income Statement to ensure accuracy and analyze the financial performance of the company.

05

Make Adjustments: If needed, make any necessary adjustments to the Income Statement to reflect any changes in the financial data.

06

Share and Utilize: Share the completed Income Statement with relevant stakeholders and use it to make informed financial decisions.

pdfFiller is a leading online platform that empowers users to create, edit, and share documents easily. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that users need to efficiently handle their document requirements.