Income Verification Form Template

What is income verification form template?

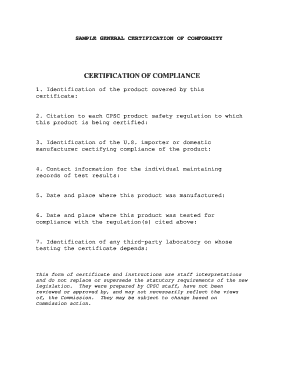

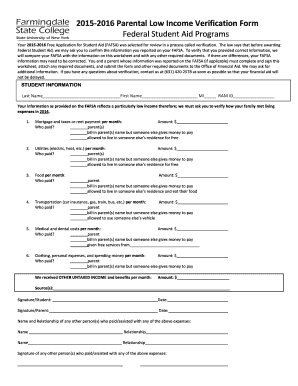

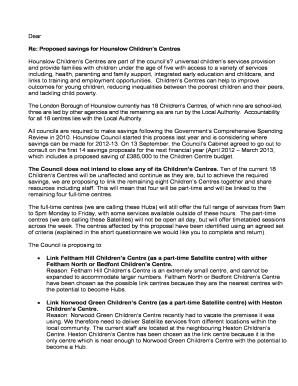

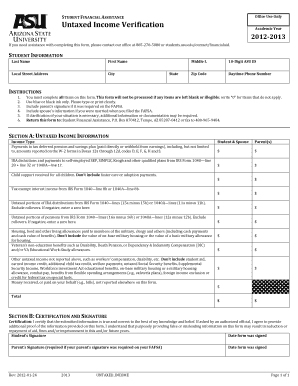

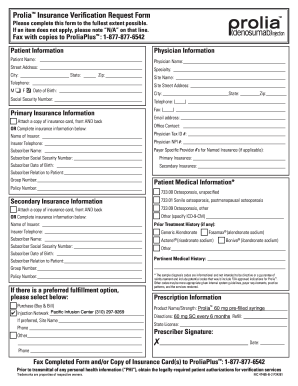

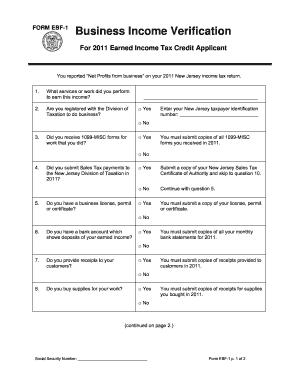

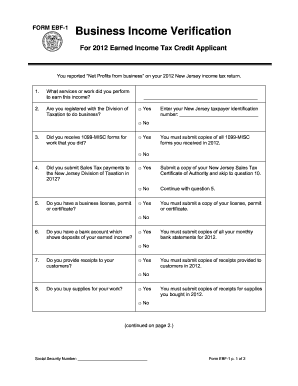

An income verification form template is a document that is used to verify an individual's income. It is commonly used by lenders, employers, and government agencies to assess a person's ability to repay a loan, determine eligibility for financial assistance, or verify income for tax purposes. This form typically requires the individual to provide information about their income sources, such as employment details, self-employment income, rental income, investment income, and other sources of revenue.

What are the types of income verification form template?

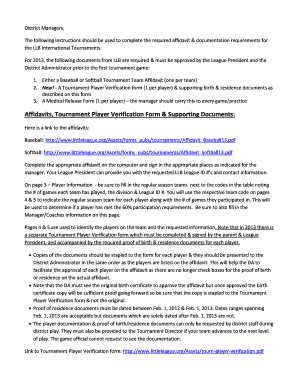

There are several types of income verification form templates that can be used depending on the specific purpose. Some common types include:

How to complete income verification form template

Completing an income verification form template is a straightforward process. Here are the steps to follow:

By using pdfFiller, users can easily create, edit, and share income verification forms online. With access to unlimited fillable templates and powerful editing tools, pdfFiller empowers users to efficiently complete their income verification forms. Whether you are a lender, employer, or individual in need of income verification, pdfFiller is the go-to PDF editor that provides all the necessary tools for getting your documents done faster and easier.