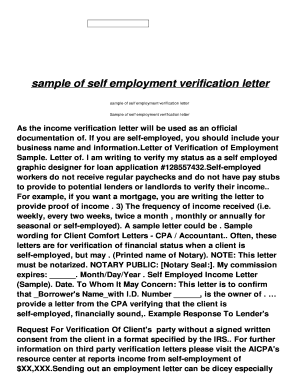

What is income verification letter for self employed?

An income verification letter for self-employed individuals is a document that confirms their income and employment status. It serves as proof of income when applying for loans, mortgages, or other financial transactions. The letter typically includes details such as the individual's name, business name, type of business, income amount, and duration of self-employment.

What are the types of income verification letter for self employed?

There are several types of income verification letters for self-employed individuals. The most common ones include:

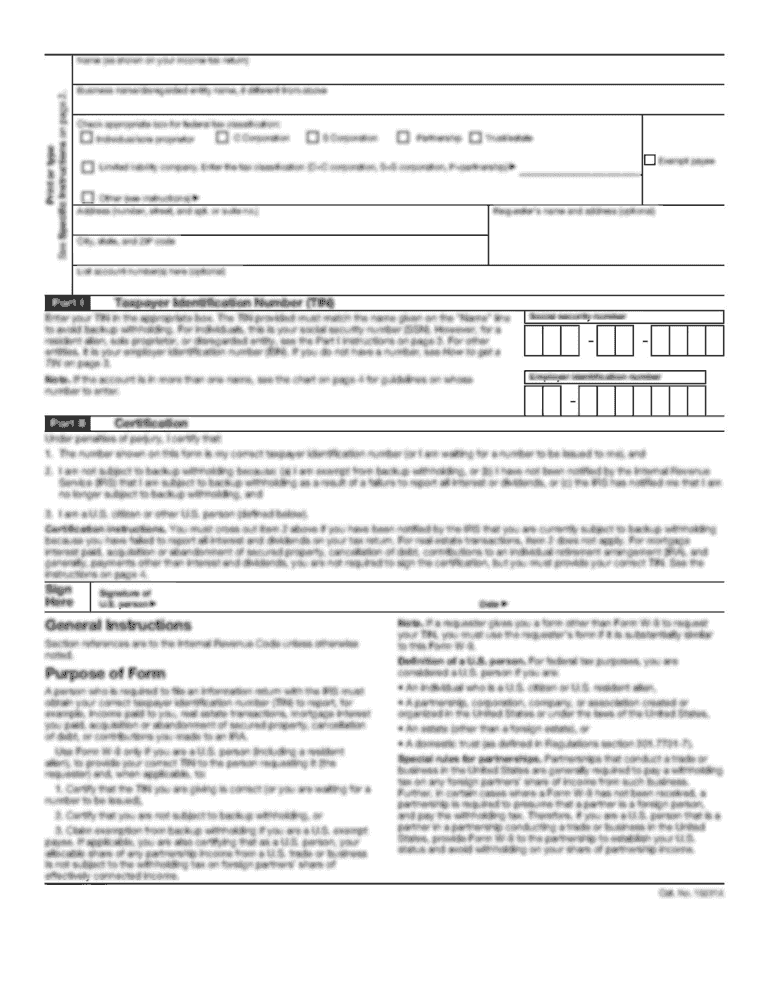

Letter from an accountant or tax professional: This type of letter is issued by a certified accountant or tax professional who verifies the individual's income based on their tax returns and financial statements.

Bank statements: Self-employed individuals can provide bank statements that show regular deposits and transactions as proof of their income.

Client contracts and invoices: Providing copies of client contracts and invoices can also serve as a form of income verification for self-employed individuals.

Profit and loss statement: This document summarizes the self-employed individual's business income and expenses, providing a clear picture of their financial situation.

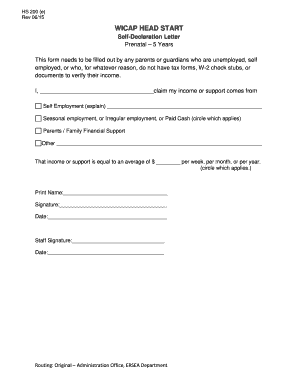

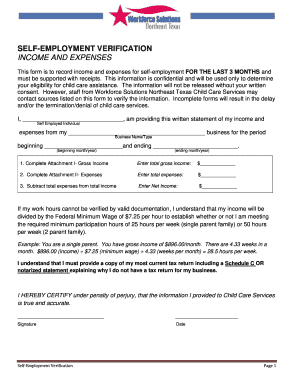

How to complete income verification letter for self employed

To complete an income verification letter for self-employed individuals, follow these steps:

01

Include the individual's name, contact information, and business name at the beginning of the letter.

02

Clearly state the purpose of the letter and the duration of time the individual has been self-employed.

03

Provide details of the individual's income, including average monthly or yearly earnings.

04

Include any supporting documentation such as bank statements, client contracts, or profit and loss statements.

05

End the letter by offering contact information for further inquiries and thanking the reader for their time.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.