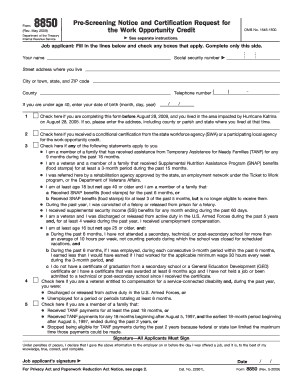

8850 Form

What is 8850 Form?

The 8850 Form, also known as the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, is a document used by employers to request certification from the state workforce agency for an employee they plan to hire. This form is an essential part of the Work Opportunity Tax Credit (WOTC) program, which aims to encourage the hiring of individuals from certain target groups who face barriers to employment.

What are the types of 8850 Form?

There is only one type of 8850 Form, which is the standard Pre-Screening Notice and Certification Request for the Work Opportunity Credit. This form is applicable to all employers who wish to participate in the WOTC program and want to claim the tax credit for hiring targeted employees.

How to complete 8850 Form

Completing the 8850 Form is a straightforward process. Here are the steps:

By using pdfFiller, you can easily complete the 8850 Form online. pdfFiller empowers users to create, edit, and share documents online, including the 8850 Form. With its unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently handle your document needs.