Interest Free Loan Agreement

What is Interest Free Loan Agreement?

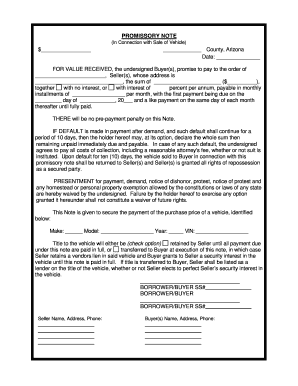

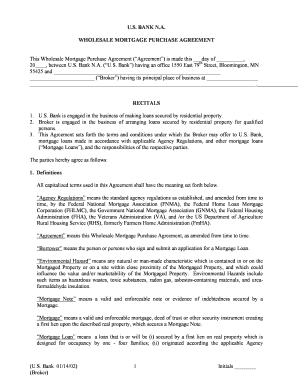

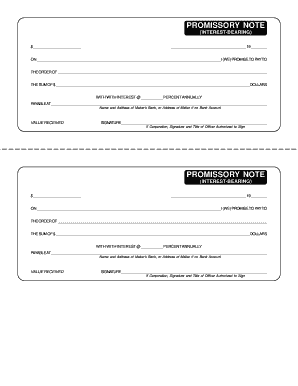

An interest-free loan agreement is a legal contract between two parties where one party lends money to another party without charging any interest. This type of agreement is typically used when one party wants to provide financial assistance to another party without expecting any monetary gain in return. The terms and conditions of the loan agreement, including the repayment schedule and any collateral required, are clearly defined in the document to ensure that both parties are protected.

What are the types of Interest Free Loan Agreement?

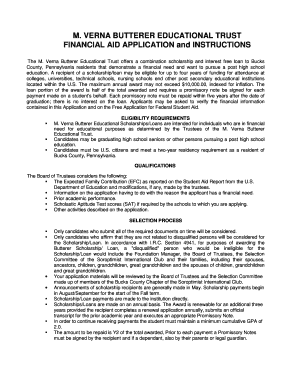

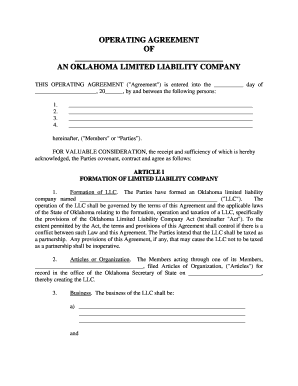

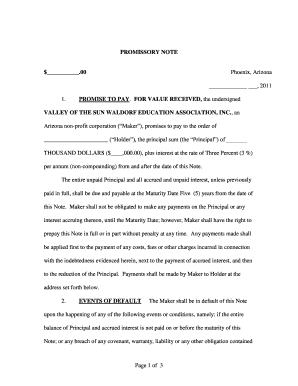

There are different types of interest-free loan agreements that can be used depending on the specific circumstances. Some common types include: 1. Personal Interest Free Loan Agreement: This type of agreement is used between individuals, such as friends or family members, who want to provide financial assistance without charging interest. 2. Business Interest Free Loan Agreement: This type of agreement is used between businesses or organizations to provide interest-free loans for various purposes, such as funding startup capital or expanding operations. 3. Non-Profit Interest Free Loan Agreement: This type of agreement is used by non-profit organizations to provide interest-free loans to individuals or other organizations for charitable purposes. 4. Government Interest Free Loan Agreement: This type of agreement is used by government entities to provide interest-free loans to individuals or businesses for specific purposes, such as promoting economic growth or supporting sustainable development.

How to complete Interest Free Loan Agreement

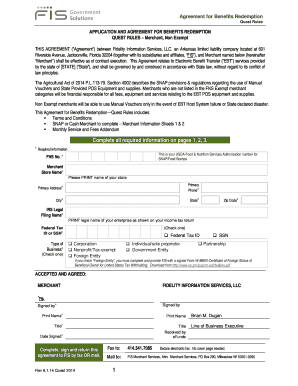

Completing an interest-free loan agreement involves several key steps to ensure that both parties are in agreement and protected. Here is a step-by-step guide: 1. Gather all necessary information: Collect all relevant information about the lender, borrower, loan amount, repayment terms, and any collateral required. 2. Use a reliable platform: Choose a trusted platform like pdfFiller to create and edit your loan agreement online. 3. Customize the template: Select a suitable interest-free loan agreement template and customize it according to your specific needs. 4. Fill in the details: Enter the relevant information into the loan agreement template, including the names and contact details of both parties, loan amount, repayment terms, and any additional clauses or conditions. 5. Review and finalize: Carefully review the completed loan agreement to ensure accuracy and clarity. Make any necessary changes and obtain the signatures of both parties. 6. Distribute and store copies: Share copies of the signed loan agreement with all parties involved, and securely store the original document for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.