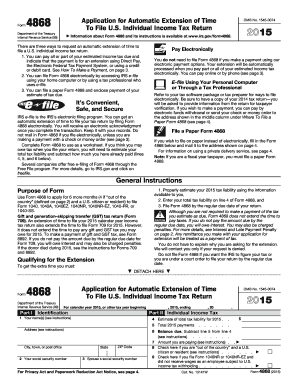

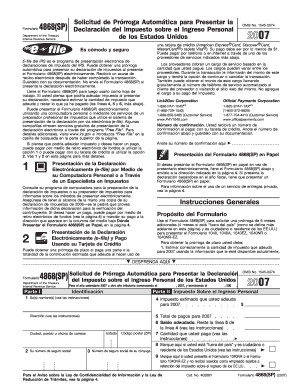

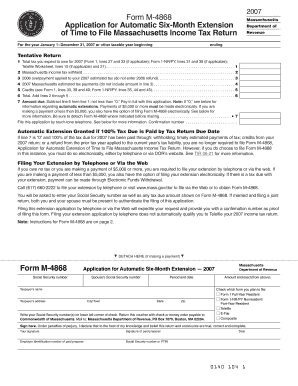

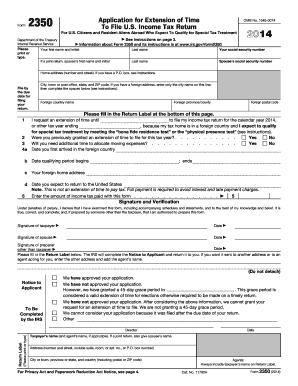

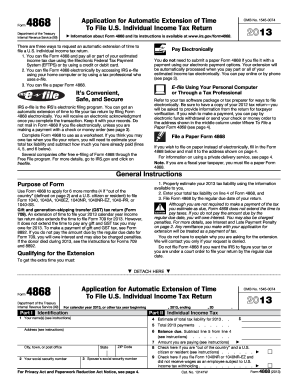

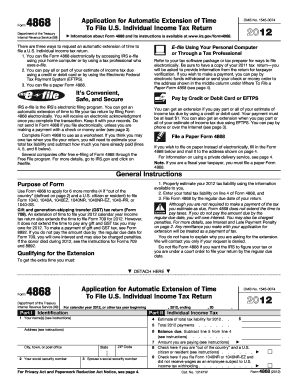

Irs Form 4868 Automatic Extension 2016

Video Tutorial How to Fill Out irs form 4868 automatic extension 2016

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I get a copy of my form 4868 TurboTax?

Simply sign in at TurboTax.com with the same login you used to e-file. You'll see a link where you can print the 4868, right underneath your extension status. https://ttlc.intuit.com/questions/2879424-how-do-i-print-my-4868-extension-form-after-e-filing-it-th

How do I file an IRS extension form 4868 in TurboTax Online?

(You'll still owe interest if you pay after the deadline). Open your return in TurboTax Online. (To do this, sign in to TurboTax and select Pick up where you left off). Select File an extension at the bottom of the column on the left side of the screen. Follow the on-screen instructions to e-file your extension.

How can I get proof of tax extension?

To confirm receipt, it's easiest if you use software like TurboTax Easy Extension, since you'll get a confirmation from TurboTax within 48 hours. If you use the U.S. mail to send your extension, you'll have to contact the Internal Revenue Service (IRS) to ask about extension status.

Where do I enter an extension on TurboTax?

Follow these steps to enter an amount paid with the extension: Go to the Input Return tab. On the left-side menu, select Payments, Penalties & Extensions. Click on 2021 Estimated Payments. Scroll down to the Paid with Extension (not later than April 15, 2022) section. Enter the amount in Amount paid.

How do I print 4868 extension?

Form 4868 - Printing a Copy From within your TaxAct return (Online or Desktop), click Filing to expand, then click File Extension. The program will proceed with the interview questions for you to review. On the screen titled Form 4868-Filing, you will have the option to print.

What is the tax extension deadline for 2016?

To collect refunds for tax year 2016, taxpayers must file their 2016 tax returns with the IRS no later than this year's extended tax due date of July 15, 2020.

Related templates