What is irs forms 1099?

IRS Forms 1099 are official documents used by the Internal Revenue Service (IRS) in the United States for various reporting purposes. These forms are used to report income received by individuals, businesses, and other entities that are not classified as employees. It is important to understand the different types of IRS Forms 1099 and how to complete them accurately to fulfill your tax obligations.

What are the types of irs forms 1099?

The IRS provides several types of Forms 1099, each catering to different types of income and reporting requirements. Some common types of IRS Forms 1099 include:

Form 1099-MISC for reporting miscellaneous income, such as non-employee compensation and royalties.

Form 1099-INT for reporting interest income earned from investments and financial accounts.

Form 1099-DIV for reporting dividends received from investments and mutual funds.

Form 1099-B for reporting proceeds from broker and barter exchange transactions.

Form 1099-R for reporting distributions from pensions, annuities, IRAs, and retirement plans.

Form 1099-G for reporting certain government payments, such as unemployment compensation and state tax refunds.

Form 1099-K for reporting payments received through third-party network transactions, such as online platforms and payment processors.

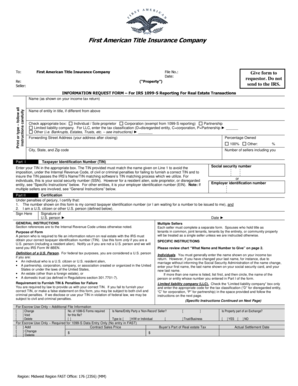

How to complete irs forms 1099

Completing IRS Forms 1099 accurately is crucial to meet your tax obligations. Here are the general steps to complete IRS Forms 1099:

01

Gather all relevant information, including the payer's and recipient's details, income amounts, and any applicable tax withholding.

02

Choose the appropriate type of IRS Form 1099 based on the income you are reporting.

03

Fill in the required fields on the form, such as the recipient's name, address, and taxpayer identification number (TIN).

04

Enter the income amounts in the appropriate boxes, ensuring accuracy and careful reporting.

05

If applicable, provide details of any tax withheld from the income in the designated sections.

06

Review the completed form for any errors or omissions, and make necessary corrections.

07

Retain a copy of the completed form for your records, and submit the appropriate copies to the IRS and the recipient, following the specific instructions for each form.

pdfFiller is an excellent tool that empowers users to create, edit, and share documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller is the best PDF editor you need to efficiently complete your IRS Forms 1099 and other important documents.