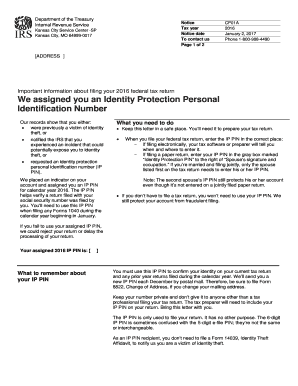

Irs Identity Theft Phone Number

What is irs identity theft phone number?

If you suspect that you have been a victim of IRS identity theft, you may need to contact the IRS to report the incident and seek assistance. The IRS identity theft phone number provides a direct line to professionals who can help you navigate through the necessary steps to resolve the issue. By contacting this phone number, you can receive valuable guidance and support in dealing with the aftermath of identity theft.

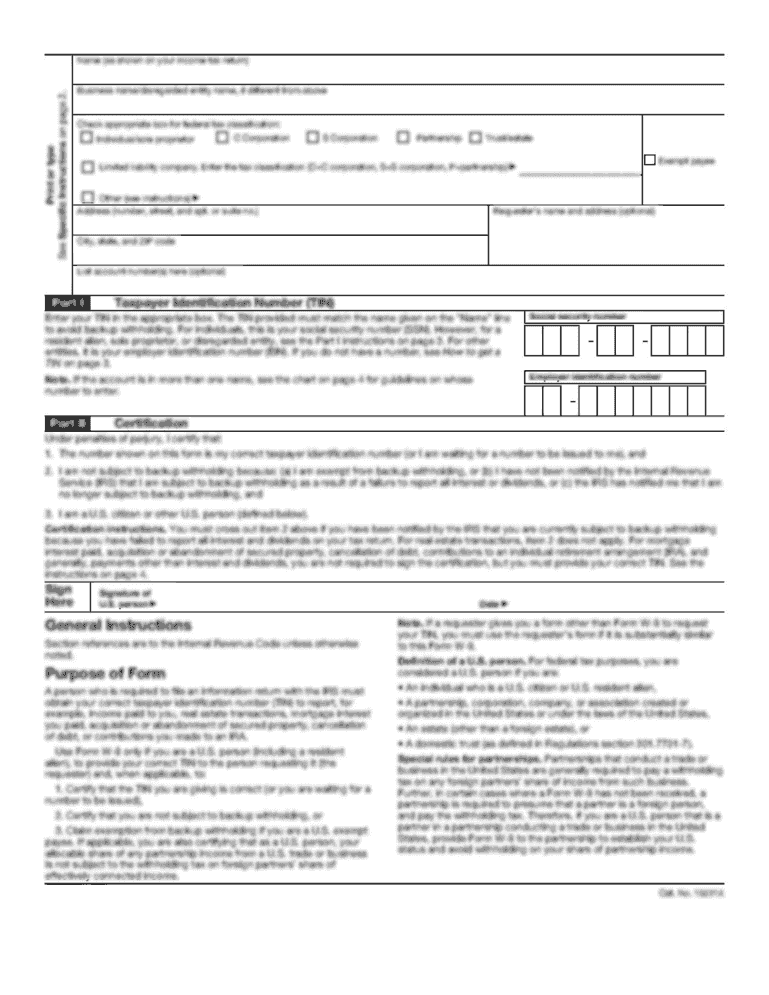

What are the types of irs identity theft phone number?

There are different types of IRS identity theft phone numbers, each serving a specific purpose. The main categories include:

How to complete irs identity theft phone number

To effectively complete the IRS identity theft phone number, follow these steps:

Remember, when facing IRS identity theft, it is crucial to act promptly and reach out to the relevant authorities for assistance. pdfFiller empowers users to create, edit, and share documents online, making it easier for individuals to handle their paperwork efficiently. With unlimited fillable templates and powerful editing tools, pdfFiller stands as the go-to PDF editor for those looking to get their documents done seamlessly.