Irs Identity Theft Pin

What is IRS Identity Theft PIN?

An IRS Identity Theft PIN (Personal Identification Number) is a six-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security numbers on fraudulent tax returns. This PIN provides an extra layer of security and helps protect individuals from becoming victims of tax-related identity theft. The IRS uses this PIN to verify the identity of the taxpayer and ensure that the tax return being filed is legitimate.

What are the types of IRS Identity Theft PIN?

There are primarily two types of IRS Identity Theft PIN: 1. Traditional Identity Theft PIN: This is the most commonly used type of PIN. It is issued to taxpayers who have been victims of identity theft in the past and have been verified by the IRS. 2. Opt-In Program PIN: This type of PIN is available to all taxpayers who wish to voluntarily participate in the program. By opting in, taxpayers can proactively protect their tax returns from identity theft.

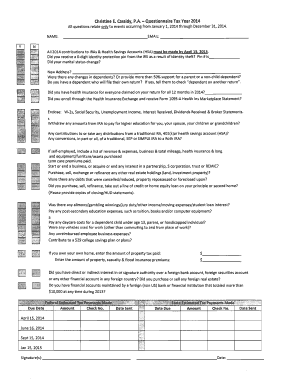

How to complete IRS Identity Theft PIN

Completing the IRS Identity Theft PIN requires the following steps: 1. Determine Eligibility: Check if you are eligible for an IRS Identity Theft PIN by visiting the official IRS website. 2. Request a PIN: If you are eligible, request an IRS Identity Theft PIN by following the instructions provided on the website. 3. Verify Your Identity: The IRS will verify your identity before issuing the PIN. This may involve answering security questions or providing necessary documentation. 4. Receive and Use Your PIN: Once your identity is verified, the IRS will issue your Identity Theft PIN. Use this PIN when filing your tax return to ensure its authenticity and protect yourself from identity theft.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.