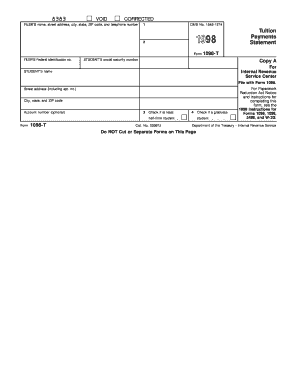

Irs Payment Phone Number

What is irs payment phone number?

The IRS payment phone number is a contact number provided by the Internal Revenue Service (IRS) for taxpayers to make payments over the phone. This service is available for individuals and businesses who prefer to make their payments through a phone call instead of other methods such as online or by mail.

What are the types of irs payment phone number?

There are two types of IRS payment phone numbers available:

Automated Phone System: This type of phone number allows taxpayers to make payments through an automated system. It is available 24/7 and provides a convenient option for those who prefer a self-service approach.

Live Customer Service Representative: This type of phone number connects taxpayers with a live customer service representative who can assist with the payment process. It is available during certain hours, typically on business days.

How to complete irs payment phone number

To complete an IRS payment over the phone, follow these steps:

01

Gather your payment information: Make sure to have your tax ID number, payment amount, and bank account information ready.

02

Dial the appropriate IRS payment phone number: Depending on whether you prefer the automated system or a live representative, choose the corresponding number from the IRS website.

03

Follow the prompts or provide information to the customer service representative: Be ready to input the required details or provide them to the representative to complete your payment.

04

Confirm and record the payment confirmation number: Once the payment is processed, make sure to jot down the confirmation number for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out irs payment phone number

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

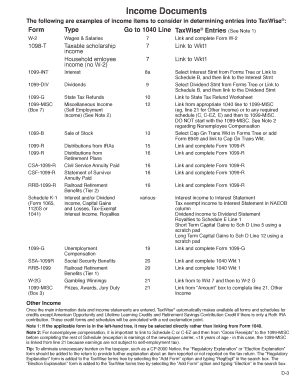

What is the form number for the IRS for the payment plan?

Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

Can I make a payment over the phone with the IRS?

You can pay online or by phone at 800-555-3453.

How do I make a phone payment to the IRS?

The Electronic Federal Tax Payment System is a free service that gives taxpayers a safe and convenient way to pay individual and business taxes online or by phone using the EFTPS® Voice Response System. For enrollment information, visit EFTPS.gov or call 800-555-4477.

Can IRS payments be made over the phone?

You can pay online or by phone at 800-555-3453. With EFTPS you can opt in to receive email notifications, about your electronic payments.

What are the two primary ways you can make a tax payment?

Taxpayers can pay tax bills directly from a checking or savings account free with IRS Direct Pay. Taxpayers receive instant confirmation once they've made a payment. With Direct Pay, taxpayers can schedule payments up to 30 days in advance.

Related templates