Irs Payment Plan Balance

Video Tutorial How to Fill Out irs payment plan balance

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What form is needed for IRS payment plan?

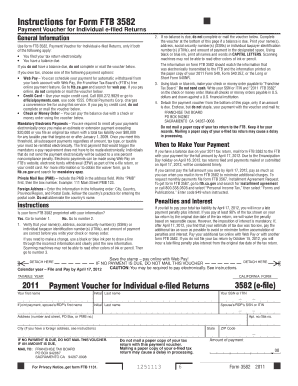

Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

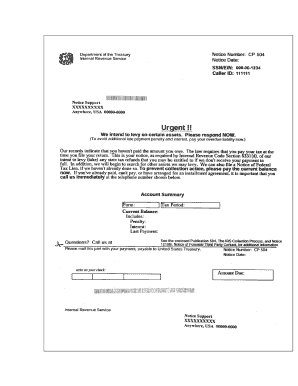

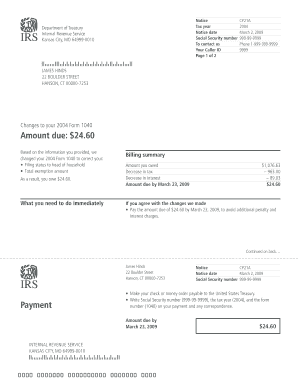

How do I find out the balance on my IRS installment agreement?

You can access your federal tax account through a secure login at IRS.gov/account. Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return.

What is a form 433-D used for?

What is IRS Form 433-D? It is a form taxpayers can submit to authorize a direct debit payment method for an IRS installment agreement. In other words, taxpayers leverage it to set up a direct debit installment agreement. Taxpayers generally use can initiate this direct debit method on this form or form 9465.

What documents do I need to make a payment plan with the IRS?

If you are filing a Form 1040 for the current tax year and cannot pay the balance in full: You may request a payment plan (including an installment agreement) using the OPA application. Alternatively, you may submit a Form 9465 with your return.

How do I get a copy of my IRS payment plan agreement?

You can view details of your current payment plan (type of agreement, due dates, and amount you need to pay) by logging into the Online Payment Agreement tool using the Apply/Revise button below.

Can I get a copy of my IRS installment agreement online?

You can view details of your current payment plan (type of agreement, due dates, and amount you need to pay) by logging into the Online Payment Agreement tool using the Apply/Revise button below.

Related templates