Irs Payment Plan Calculator

What is irs payment plan calculator?

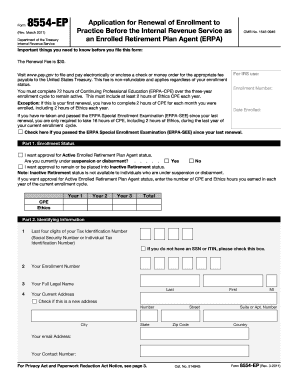

The irs payment plan calculator is a tool offered by the Internal Revenue Service (IRS) to help individuals determine their monthly payment amount for an installment agreement with the IRS. This calculator takes into account various factors such as the amount owed, the individual's income and expenses, and the desired repayment period. By using the irs payment plan calculator, users can get an estimate of their monthly payment and create a plan to have their tax debt paid off over time.

What are the types of irs payment plan calculator?

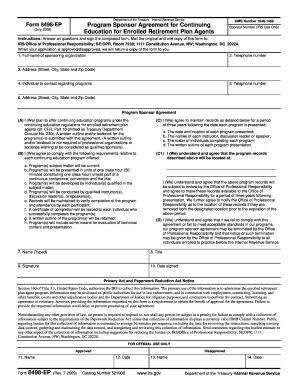

There are different types of irs payment plan calculators available, depending on the specific needs of the taxpayer. Some of the common types include: 1. Online calculator: This type of calculator can be accessed through the IRS website and is available to anyone who wants to determine their payment plan options. 2. Tax professional calculator: Tax professionals often have access to more advanced calculators that take into account specific tax laws and regulations, allowing for a more accurate calculation of the payment plan options.

How to complete irs payment plan calculator

Completing the irs payment plan calculator is easy and can be done in a few simple steps: 1. Gather information: Before starting the calculator, make sure to have the necessary information, such as the amount owed, income details, and expenses. 2. Access the calculator: Visit the IRS website or consult with a tax professional to access the appropriate calculator. 3. Enter information: Follow the prompts on the calculator to enter the required information accurately. 4. Review and adjust: After entering all the information, review the results provided by the calculator. If necessary, make adjustments to see how different repayment options can affect the monthly payment amount. 5. Create a plan: Once satisfied with the results, use the information generated by the calculator to create a payment plan that fits your financial situation and goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.