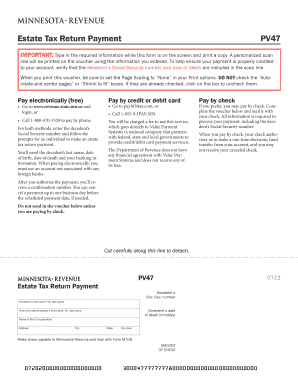

Irs Refund Payment

Video Tutorial How to Fill Out irs refund payment

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

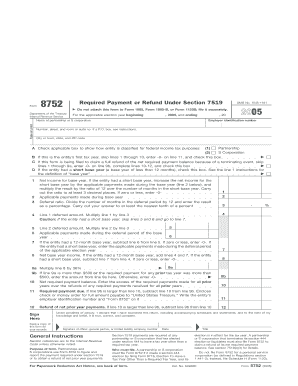

How do I set up an IRS payment plan?

What if I am not eligible or unable to apply or revise a payment plan online? Individuals can complete Form 9465, Installment Agreement Request. If you prefer to apply by phone, call 800-829-1040 (individual) or 800-829-4933 (business), or the phone number on your bill or notice.

How do I pay tax owing to CRA?

You can pay your personal and business taxes to the Canada Revenue Agency (CRA) through your financial institution's online banking app or website. Most financial institutions also let you set up a payment to be made on a future date.

What's the fastest way to receive a tax refund?

The best and fastest way to get your tax refund is to have it electronically deposited for free into your financial account. The IRS program is called direct deposit. You can use it to deposit your refund into one, two or even three accounts.

How do I make a payment to the CRA?

Pay online Online banking. Interac Debit, Visa Debit, or Debit Mastercard (using. Pre-authorized debit (PAD) Credit card, debit card, PayPal, or Interac e-Transfer. Wire transfer. Financial institution (cheque or debit) Canada Post location (debit or cash) Cheque or money order.

Can you pay the IRS back online?

Credit card, debit card or digital wallet: Individuals can pay online, by phone or with a mobile device through any of the authorized payment processors. The processor charges a fee. The IRS doesn't receive any fees for these payments. Authorized card processors and phone numbers are available at IRS.gov/payments.

What is the easiest way to pay the government or to receive your refund?

Direct Deposit is a safe, reliable, and convenient way to receive Federal payments. The Department of the Treasury's Bureau of the Fiscal Service and the Internal Revenue Service both encourage direct deposit of IRS tax refunds.

Related templates