What is itemized receipt for reimbursement?

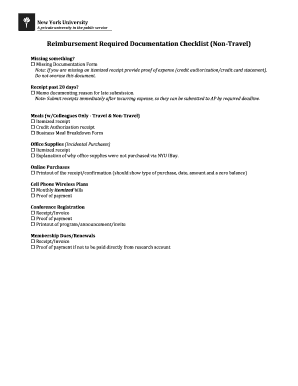

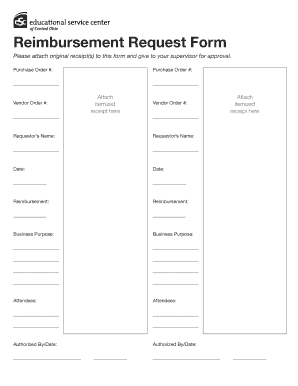

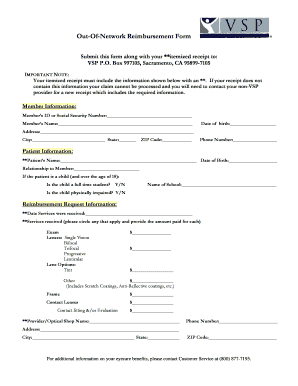

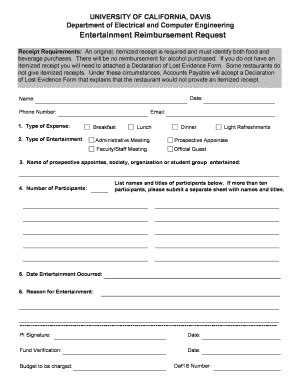

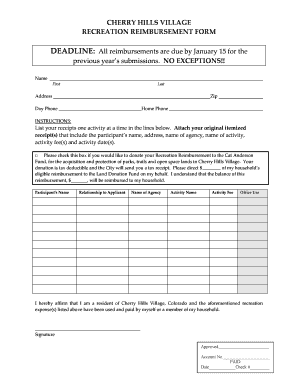

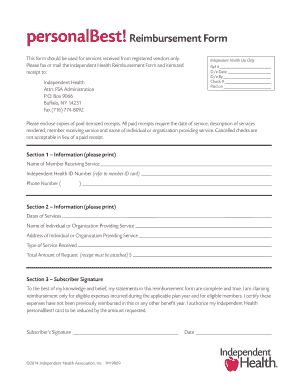

An itemized receipt for reimbursement is a detailed record of expenses incurred by an individual or business that can be submitted to seek reimbursement. It includes information such as the date of purchase, the name and address of the vendor, a description of the items purchased, their individual prices, and the total amount spent. This receipt serves as evidence of the expenses and allows for proper documentation and reimbursement.

What are the types of itemized receipt for reimbursement?

There are several types of itemized receipts for reimbursement. They include:

Retail receipts: These receipts are provided by retail stores and contain details of goods or services purchased.

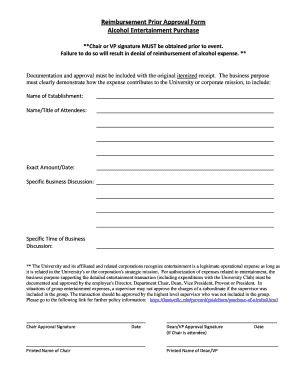

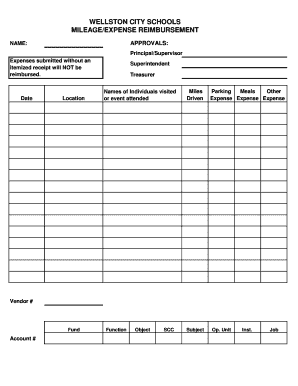

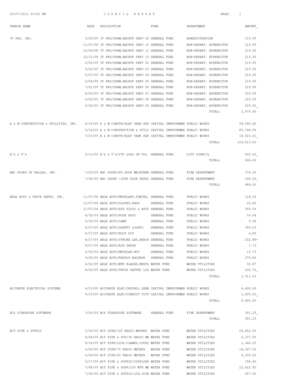

Expense reports: These receipts are generated by individuals to document various expenses such as travel, accommodation, meals, and other business-related costs.

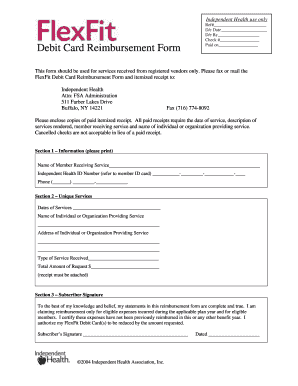

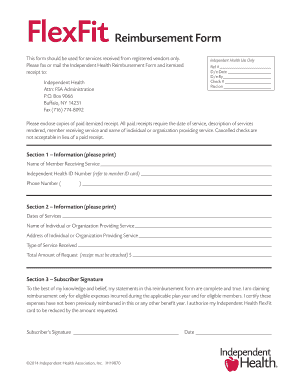

Medical receipts: These receipts are issued by healthcare providers and contain details of medical expenses incurred.

Utility bills: These receipts are provided by utility companies to document payments for services such as electricity, water, and gas.

Invoice receipts: These receipts are generated by businesses to provide detailed information about goods or services purchased and the associated costs.

How to complete itemized receipt for reimbursement

Completing an itemized receipt for reimbursement is a straightforward process. Here are the steps you can follow:

01

Gather all the necessary information: Make sure you have all the relevant details, such as the date of purchase, vendor information, description of items purchased, and their individual prices.

02

Organize the information: Arrange the information in a clear and logical manner, ensuring that each item and its corresponding price are listed accurately.

03

Calculate the total amount: Add up the individual prices to calculate the total amount spent and include it in the receipt.

04

Include additional details: Depending on the requirements, you may need to include additional information such as tax amounts or any discounts applied.

05

Review and finalize the receipt: Double-check all the information for accuracy and make any necessary revisions. Once you are satisfied, finalize the receipt and ensure it is legible and easy to understand.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.