What is a loan agreement letter?

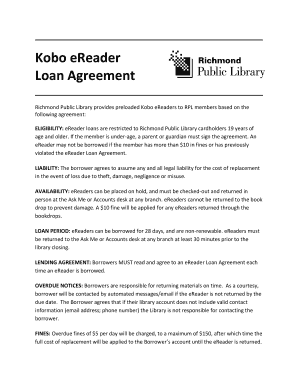

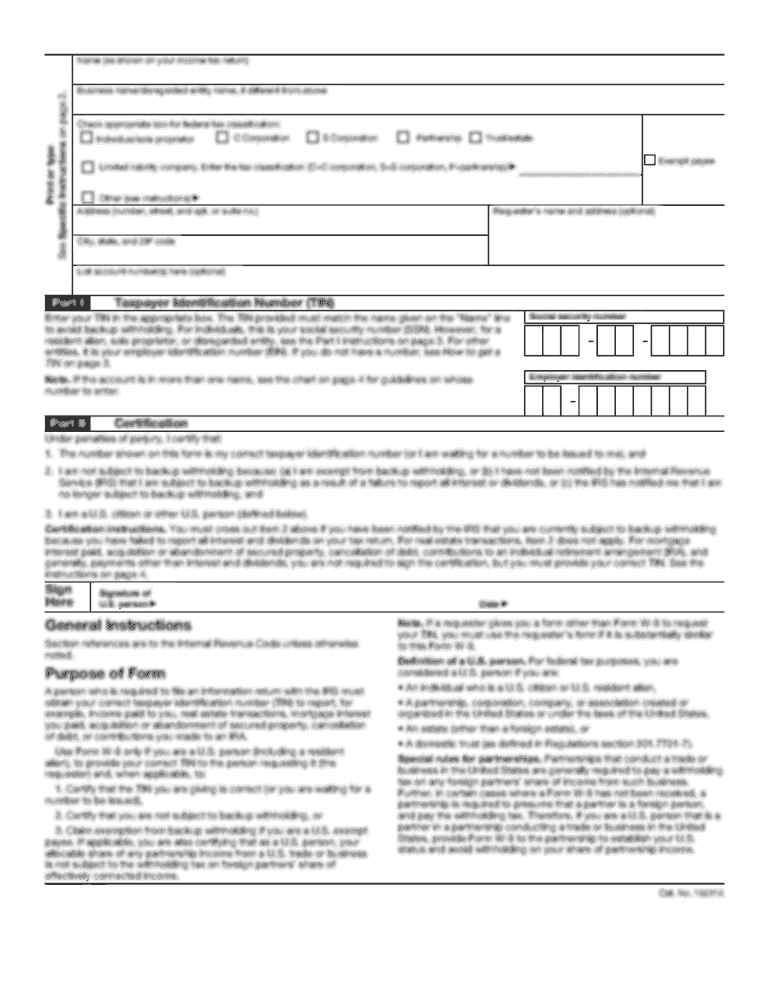

A loan agreement letter is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It serves as proof of the agreement and helps protect the rights and interests of both parties. The letter typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral or guarantees involved.

What are the types of loan agreement letter?

There are several types of loan agreement letters, depending on the specific loan arrangement. Some common types include:

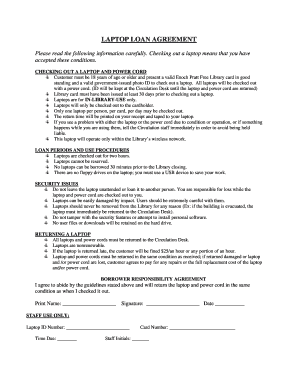

Personal Loan Agreement: This type of agreement is used for loans between individuals, such as family or friends.

Business Loan Agreement: This type of agreement is used for loans between a lender and a business entity, such as a corporation or partnership.

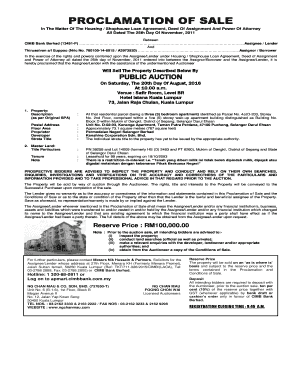

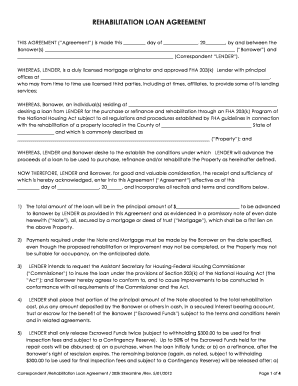

Mortgage Loan Agreement: This type of agreement is used for loans related to real estate, where the property acts as collateral.

Auto Loan Agreement: This type of agreement is used for loans related to the purchase of vehicles, where the vehicle acts as collateral.

How to complete a loan agreement letter?

Completing a loan agreement letter involves several key steps:

01

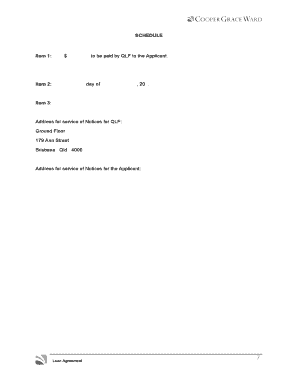

Gather the necessary information: Collect all the details required to draft the agreement, such as the names of the parties involved, loan amount, and repayment terms.

02

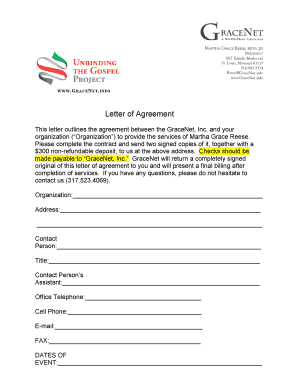

Use a template or draft the letter: Whether you choose to use a template or draft the letter from scratch, ensure that all the essential elements are included, such as the purpose of the loan, interest rate, and payment terms.

03

Review and negotiate the terms: Carefully review the letter to ensure it accurately reflects the agreed-upon terms. If necessary, negotiate any changes or clarifications with the other party.

04

Sign and date the letter: Once both parties are satisfied with the terms, sign the letter and include the date. This makes the agreement legally binding.

05

Keep a copy for your records: Make sure to keep a copy of the signed loan agreement letter for future reference and record-keeping purposes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.