Loan Agreement - Page 2

What is Loan Agreement?

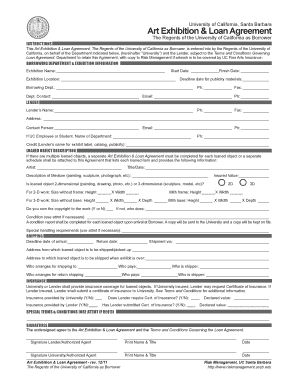

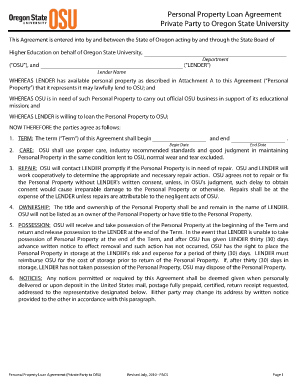

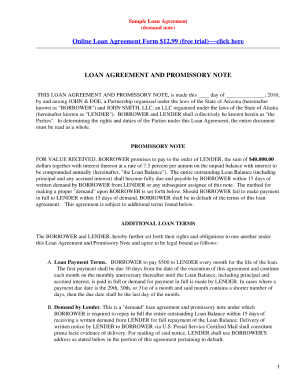

A loan agreement is a legally binding contract between a lender and a borrower. It outlines the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and any collateral or guarantees required. This agreement serves as a written record of the loan transaction and helps protect the rights and obligations of both parties involved.

What are the types of Loan Agreement?

There are several types of loan agreements, each catering to different needs and circumstances. Some common types include: 1. Personal Loan Agreement: Used for personal lending between individuals. 2. Business Loan Agreement: Used to secure financing for a business venture. 3. Mortgage Loan Agreement: Used for financing the purchase of real estate. 4. Student Loan Agreement: Used for educational purposes, typically issued by government or private lenders. 5. Secured Loan Agreement: Requires collateral to secure the loan. 6. Unsecured Loan Agreement: Does not require collateral, but generally has a higher interest rate.

How to complete Loan Agreement

Completing a loan agreement requires careful attention to detail. Here are the steps to follow: 1. Gather all necessary information: Collect information about the borrower, lender, loan amount, repayment terms, and any collateral or guarantees. 2. Draft the agreement: Use a template or consult a legal professional to create a comprehensive loan agreement that covers all essential terms. 3. Review and revise: Carefully review the agreement and make any necessary revisions to ensure accuracy and clarity. 4. Sign the agreement: Both the lender and borrower should sign the agreement to make it legally binding. 5. Keep a copy: Make copies of the signed agreement for both parties to keep as a record of the loan transaction.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.