Loan Payoff Calculator

What is a loan payoff calculator?

A loan payoff calculator is a useful financial tool that helps individuals determine the amount of time and money needed to pay off their loans. It allows users to input their loan amount, interest rate, and monthly payment to calculate the total cost and duration of their loan repayment.

What are the types of loan payoff calculators?

There are several types of loan payoff calculators available to borrowers. Some common types include:

Simple loan payoff calculator: This calculates the total cost of the loan and the monthly payment based on the loan amount, interest rate, and loan term.

Extra payment calculator: This calculator helps users determine how much time and money they can save by making extra payments towards their loan.

Amortization calculator: This tool provides a detailed breakdown of each payment throughout the loan term, including the principal, interest, and remaining balance.

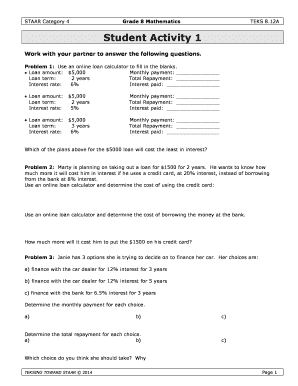

How to complete a loan payoff calculator

Completing a loan payoff calculator is easy and straightforward. Here's a step-by-step guide to help you:

01

Gather the necessary information: You'll need to know your loan amount, interest rate, and loan term.

02

Input the information: Enter the required details into the loan payoff calculator.

03

Review the results: Once you've entered all the information, the calculator will provide you with the total cost of the loan, the monthly payment, and the duration of the loan repayment.

04

Analyze and adjust: Use the results to analyze your loan repayment plan. If the numbers aren't favorable, consider making extra payments or adjusting the loan term to find a more affordable option.

With pdfFiller, you can easily create, edit, and share documents online, including loan payoff calculators. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for all your document needs.

Video Tutorial How to Fill Out loan payoff calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you calculate loan payoff?

You can calculate a mortgage payoff amount using a formula Work out the daily interest rate by multiplying the loan balance by the interest rate, then multiplying that by 365. This figure, multiplied by the days until payoff, plus the loan balance, gives you your mortgage payoff amount.

How do I calculate a loan payoff in Excel?

=PMT(17%/12,2*12,5400) For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year. The NPER argument of 2*12 is the total number of payment periods for the loan. The PV or present value argument is 5400.

What is the formula to calculate payoff?

You can calculate a mortgage payoff amount using a formula Work out the daily interest rate by multiplying the loan balance by the interest rate, then multiplying that by 365. This figure, multiplied by the days until payoff, plus the loan balance, gives you your mortgage payoff amount.

How do I calculate my loan payoff?

You can calculate a mortgage payoff amount using a formula Work out the daily interest rate by multiplying the loan balance by the interest rate, then multiplying that by 365. This figure, multiplied by the days until payoff, plus the loan balance, gives you your mortgage payoff amount.

How do I calculate a loan payoff in Google Sheets?

How Do I Calculate Loan Payments in Google Sheets? To calculate loan payments in Google Sheets, you need to use the PMT function. The PMT function calculates the periodic payment for an annuity investment, where the amount and interest rate are constant for each periodic payment.

Is the principal balance the same as the payoff?

Your principal balance is not the payoff amount because the interest on your loan is calculated in arrears. For example, when you paid your August payment you actually paid interest for July and principal for August.

Related templates