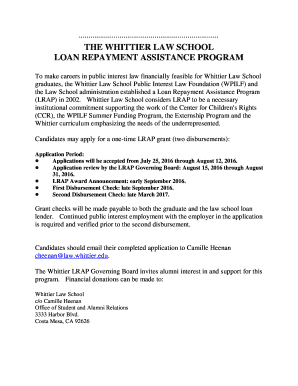

Loan Repayment Letter To Employee

What is loan repayment letter to employee?

A loan repayment letter to an employee is a formal document that outlines the terms and conditions of a loan repayment agreement between an employer and an employee. This letter serves as a written record of the loan amount, repayment schedule, and any applicable interest or penalties. It is important for both parties to have a clear understanding of their obligations and responsibilities in order to avoid any misunderstandings or disputes in the future.

What are the types of loan repayment letter to employee?

There are several types of loan repayment letters to an employee that can be used depending on the specific circumstances. Some common types include: 1. Lump sum repayment: This type of repayment letter outlines a one-time payment schedule for the full loan amount and any applicable interest or penalties. 2. Installment repayment: This type of repayment letter details a series of scheduled payments over a specified period of time to gradually repay the loan. 3. Salary deduction repayment: In this type of repayment letter, the employer deducts a portion of the employee's salary each pay period until the loan is fully repaid. 4. Combination repayment: This type of repayment letter combines different repayment methods, such as a lump sum payment followed by installment payments.

How to complete loan repayment letter to employee

Completing a loan repayment letter to an employee is a straightforward process. Here are the steps to follow: 1. Begin with a formal salutation, addressing the employee by their name. 2. Clearly state the purpose of the letter and provide a brief introduction. 3. Outline the loan repayment terms, including the loan amount, repayment schedule, and any applicable interest or penalties. 4. Specify the agreed-upon method of repayment, whether it is a lump sum payment, installment payments, or salary deductions. 5. Include any additional terms or conditions relevant to the loan repayment agreement. 6. End the letter with a polite closing, such as 'Sincerely' or 'Best regards', followed by your name and title. 7. Provide contact information in case the employee has any questions or concerns. 8. Encourage the employee to review the letter carefully and seek legal advice if needed before signing and returning a copy of the letter to confirm their agreement to the loan repayment terms.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.