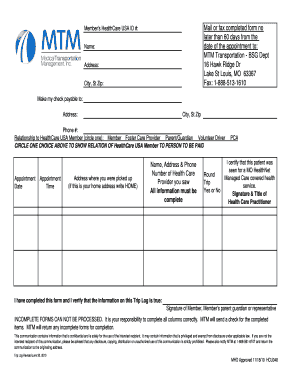

Log Sheet Template For Mileage Calculation

What is Log Sheet Template For Mileage Calculation?

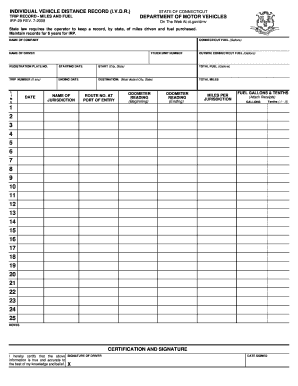

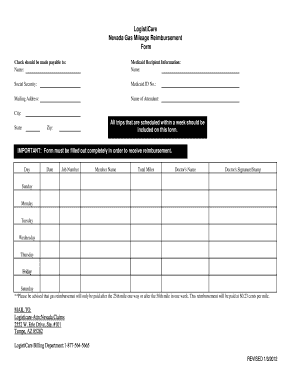

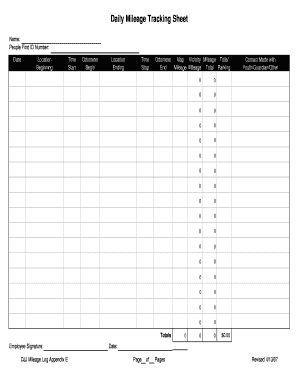

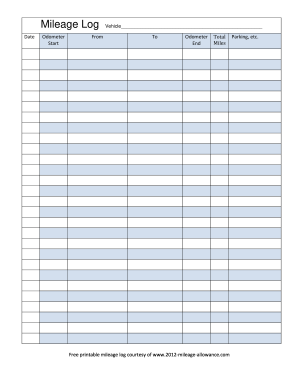

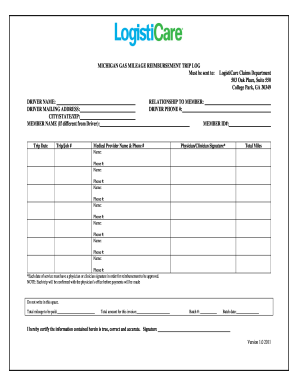

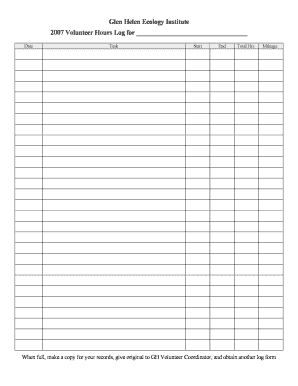

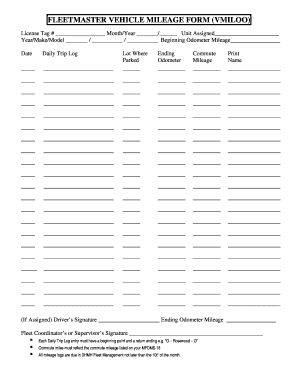

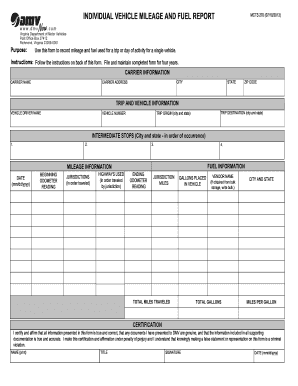

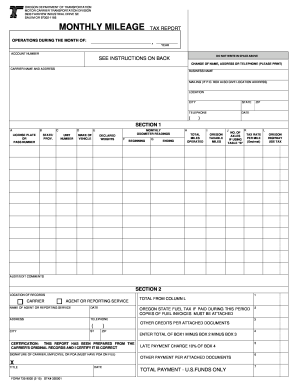

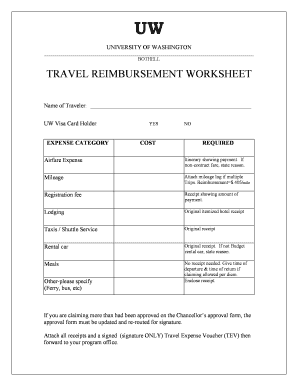

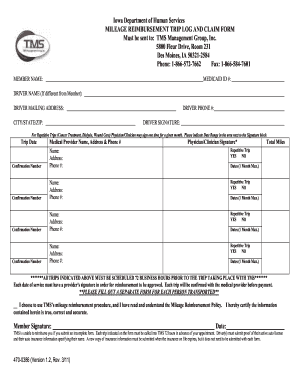

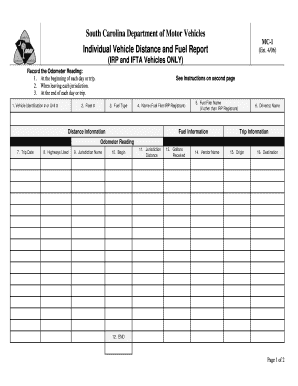

A Log Sheet Template for Mileage Calculation is a form or document that helps individuals or businesses keep track of the distances traveled for various purposes, such as business trips, transportation expenses, or tax deductions. It allows users to record the starting and ending mileage of a vehicle, along with other relevant details like the date, purpose of the trip, and any additional notes. This log sheet serves as a valuable tool for accurately calculating and organizing mileage information for personal or professional use.

What are the types of Log Sheet Template For Mileage Calculation?

There are several types of Log Sheet Templates available for mileage calculation, catering to different needs and preferences. Some common types include: 1. Basic Log Sheet Template: Simple and straightforward, it includes essential fields such as date, starting and ending mileage, purpose of the trip, and any additional notes. 2. Advanced Log Sheet Template: This template offers more comprehensive features, allowing users to input additional information like the vehicle's make and model, fuel consumption, maintenance records, and more. 3. Electronic Log Sheet Template: In this digital age, electronic log sheet templates provide the convenience of automatic calculations, data storage, and easy accessibility on various devices such as computers, smartphones, or tablets. Regardless of the type, Log Sheet Templates for Mileage Calculation are designed to simplify the process of tracking mileage and help users maintain a clear record of their travel expenses and usage of vehicles.

How to complete Log Sheet Template For Mileage Calculation

Completing a Log Sheet Template for Mileage Calculation is a straightforward process that involves the following steps: 1. Download or Access the Template: Start by obtaining the Log Sheet Template that suits your needs. You can download printable templates from reliable websites or access electronic templates provided by software applications like pdfFiller. 2. Enter the Required Information: Begin by filling in the essential details such as the date, starting mileage, and purpose of the trip. Depending on the template, you may also need to provide additional information like the vehicle's make and model. 3. Record the Ending Mileage: Once the trip is completed, record the final mileage of the vehicle. This can be obtained from the odometer or any tracking device installed. 4. Add Any Additional Notes: If necessary, include any relevant notes or comments regarding the trip, such as the destination, people involved, or specific details that may be important for future reference. 5. Save and Store the Log Sheet: After completing the necessary fields, save the log sheet either as a digital file or a printed document. Organize and store it in a secure location for easy access and retrieval when needed. By following these steps, you can effectively complete a Log Sheet Template for Mileage Calculation and maintain an accurate record of your travel expenses and mileage usage.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. With its user-friendly interface and extensive features, pdfFiller makes completing Log Sheet Templates for Mileage Calculation a seamless and efficient process. Whether you prefer a printable log sheet or an electronic version, pdfFiller provides the flexibility and convenience to meet your needs.