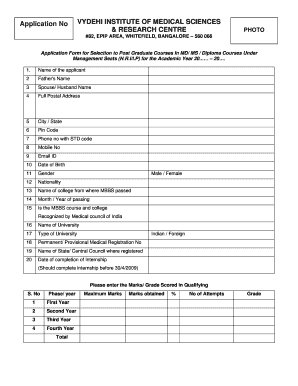

Microsoft Excel Form Wh 347 - Page 2

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you run certified payroll in QuickBooks?

Direct integration with QuickBooks Online allows for employee data, hours by day, project information, paycheck values, and more to flow seamlessly from QuickBooks into Certified Payroll Reporting each pay period, and then directly onto any required prevailing wage reports.

What is a statement of non performance?

In the event there has been no work performed during a given week on the project, the Statement of Non-Performance (“SNP”) can be filled out for that week. A subcontractor must submit a SNP or Certified Payroll Report for each week on the job until their scope of work is complete.

What is the difference between payroll and certified payroll?

Certified payroll reports are special payroll reports that contractors who work on public works or government funded construction projects must file on a weekly basis. This type of payroll requires a specialized process involving the input of a date and job code with each entry.

What does it mean to be payroll certified?

Certified payroll is a special weekly payroll report using Form WH-347 that contractors who are working on federally-funded projects need to complete and submit to prove they are paying workers the prevailing wage.

Can I do certified payroll in QuickBooks online?

If you use QuickBooks Online Payroll, we don't support prevailing wages or certified payroll reports. If you use QuickBooks Desktop Payroll Enhanced or QuickBooks Desktop Payroll Assisted, see Certified Payroll on how to create a certified payroll report.

What is certified payroll California?

A CPR is an official compliance document that is required on local-, state-, and/or federal-funded projects. It details the worker's information, type of work performed, wages, benefits, and hours worked. On California prevailing wage projects, the form typically used is form A-1-131.

Related templates