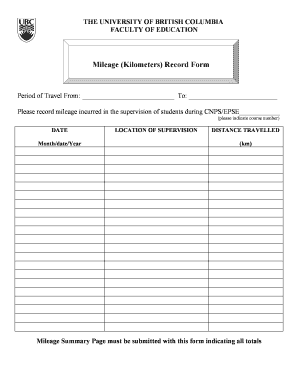

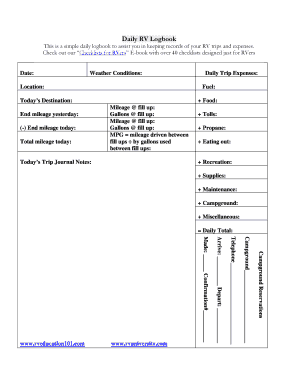

What is mileage log book pdf?

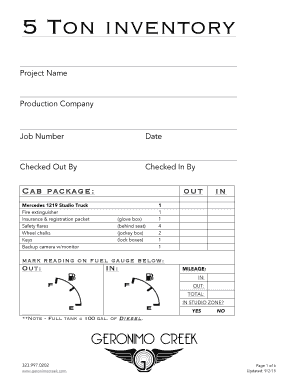

A mileage log book pdf is a digital document that allows individuals or businesses to keep track of their mileage for various purposes. It is commonly used by individuals who need to track their mileage for tax deductions or reimbursement purposes. The log book pdf contains fields to record important information such as the date of travel, starting and ending odometer readings, purpose of the trip, and total miles driven.

What are the types of mileage log book pdf?

There are several types of mileage log book pdf templates available, depending on the specific needs of the user. Some common types include:

Standard mileage log book: This type of log book is suitable for individuals who use their personal vehicle for business purposes and need to track their mileage for tax deductions.

Fleet mileage log book: This log book is designed for businesses with multiple vehicles. It allows for tracking the mileage of each vehicle separately.

Employee reimbursement log book: This log book is used by businesses to track the mileage of their employees for reimbursement purposes.

IRS-compliant log book: This log book template follows the guidelines set by the Internal Revenue Service (IRS) for accurate mileage tracking and tax deductions.

How to complete mileage log book pdf

Completing a mileage log book pdf is a simple process. Here are the steps:

01

Open the mileage log book pdf template in a PDF editor like pdfFiller.

02

Enter the date of travel, starting and ending odometer readings, purpose of the trip, and total miles driven in the designated fields.

03

Save the completed log book for future reference or printing.

04

Repeat the process for each trip you need to track.

05

Review the log book regularly to ensure accuracy and make any necessary updates.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.