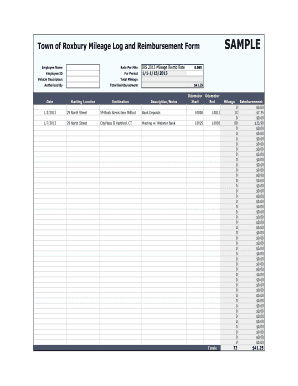

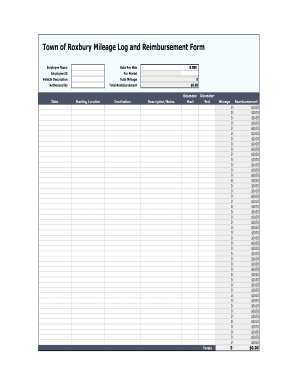

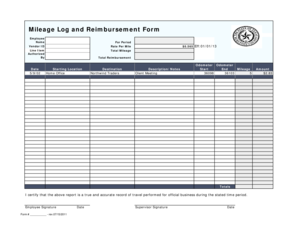

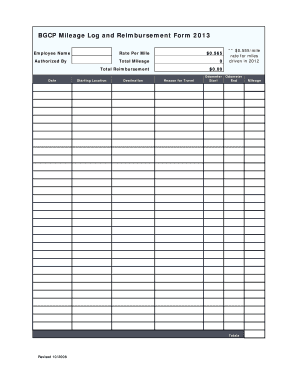

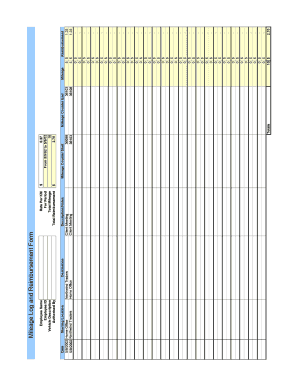

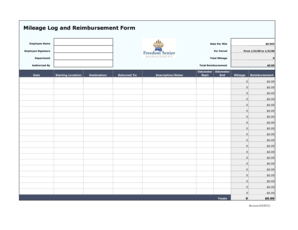

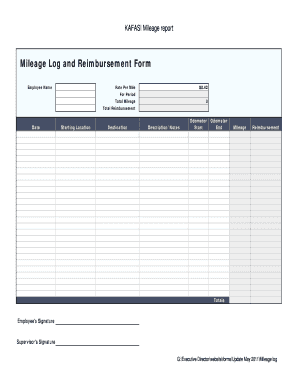

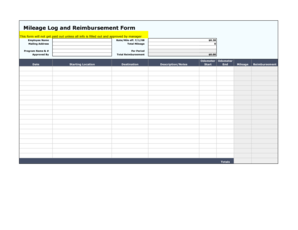

Mileage Log With Reimbursement Form - Page 2

Video Tutorial How to Fill Out Mileage Log With Reimbursement Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Do I need fuel receipts to claim mileage?

Fuel receipts to support claiming VAT on mileage. The question often arises “Do I need to keep fuel receipts, as I'm not claiming for the fuel I purchased? “. The answer is yes, you must keep the fuel receipts if you want to claim the VAT on the mileage expenses.

How do you prove mileage to HMRC?

According to HMRC, your mileage log should include: The date of your journey. If it is a personal or business-related journey. The start and end addresses, including postcodes. The total number of miles driven for the journey.

How do I prove my mileage for taxes?

How do you keep a mileage log? Keep a separate bank account or credit card for business expenses. This can be a great way to keep personal and driving expenses separated. Record mileage on paper or in a spreadsheet. Use a mile-tracking app. Use your Uber or Lyft app to track mileage deductions (not recommended).

How do I make a mileage log book?

What to record in your mileage log book total mileage for the year. odometer readings at the start and end of the year. mileage for each business trip. Time of the drip (the day will suffice) place (your destination) Purpose of the trip.

What happens if you forget to track mileage?

Forgot to Track Your Mileage: What the IRS Says “If you don't have complete records to prove an element of an expense, then you must prove the element with: Your own written or oral statement containing specific information about the element, and. Other supporting evidence that is sufficient to establish the element.”

How do I track mileage for a 1099?

Maintain a Driving Log (If Needed) You must keep a log of the total miles driven if you choose to take the standard mileage deduction. The IRS is quite specific on this point: At the start of each trip, record the odometer reading and list the purpose, starting location, ending location, and date of the trip.

Related templates