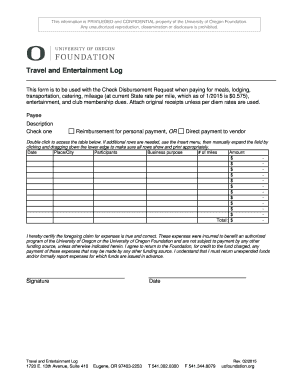

Mileage Log

What is Mileage Log?

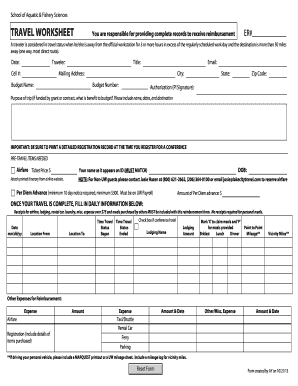

A mileage log is a record of the number of miles traveled for business or tax purposes. It helps individuals and businesses keep track of their travel expenses and claim tax deductions.

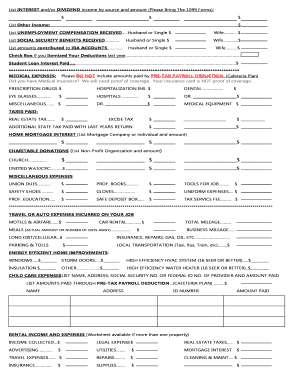

What are the types of Mileage Log?

There are two main types of mileage logs: paper-based and digital. Paper-based mileage logs involve manually recording mileage in a notebook or logbook. Digital mileage logs, on the other hand, use software or apps that automatically track and record mileage using GPS or other technologies.

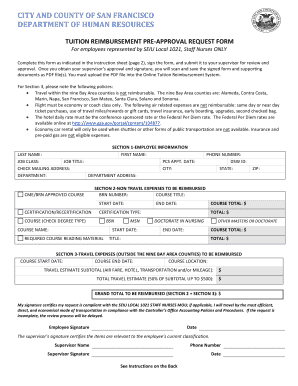

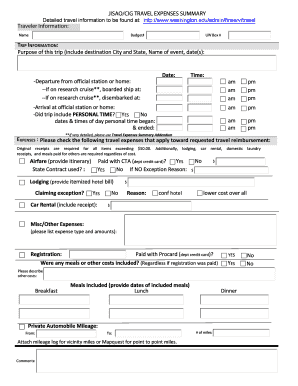

How to complete Mileage Log

Completing a mileage log is a simple process that can help you accurately track and report your mileage. Here are the steps to complete a mileage log:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.