Mileage Reimbursement Request Form

What is Mileage Reimbursement Request Form?

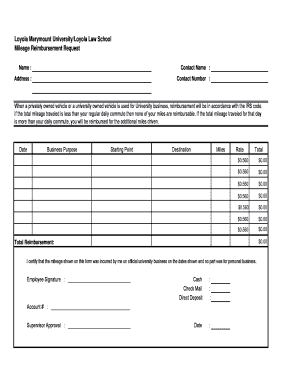

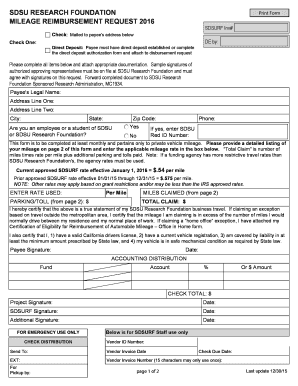

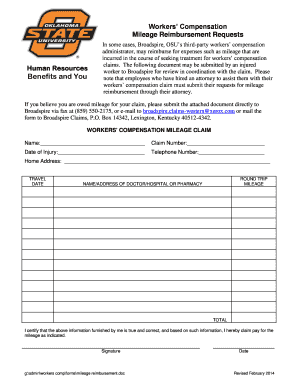

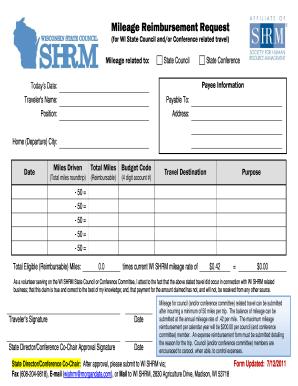

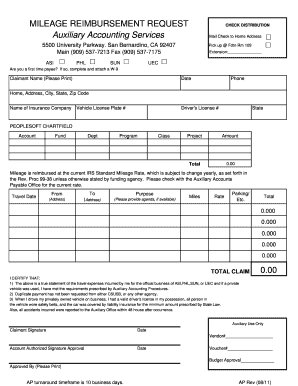

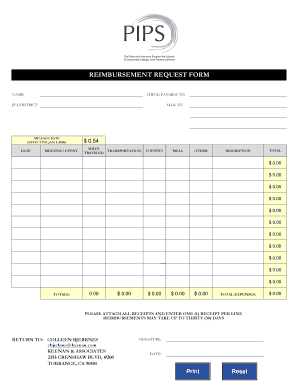

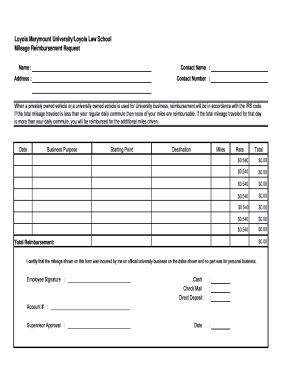

A Mileage Reimbursement Request Form is a document used to formally submit a request for reimbursement for the mileage expenses incurred during business-related travel. This form allows individuals to specify the purpose of the trip, date, starting point, destination, and the number of miles traveled. It is essential for organizations to have a standardized form to ensure accurate and efficient processing of mileage reimbursement requests.

What are the types of Mileage Reimbursement Request Form?

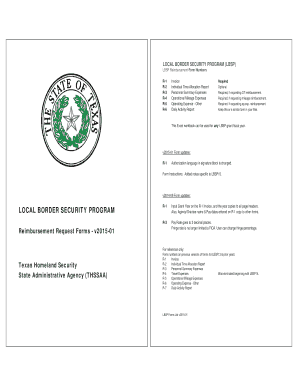

There are various types of Mileage Reimbursement Request Forms available depending on the specific requirements of each organization. Some common types include:

How to complete Mileage Reimbursement Request Form

Completing a Mileage Reimbursement Request Form is a straightforward process. Here is a step-by-step guide to help you:

By utilizing pdfFiller, individuals can effortlessly create, edit, and share their Mileage Reimbursement Request Forms online. With access to unlimited fillable templates and powerful editing tools, pdfFiller becomes the go-to PDF editor that allows users to efficiently handle all their document needs.