What is Mileage Report Form?

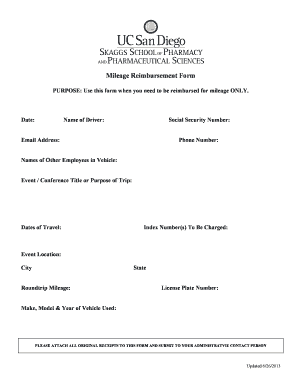

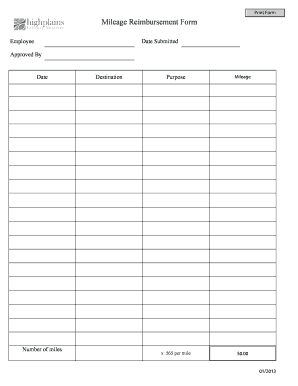

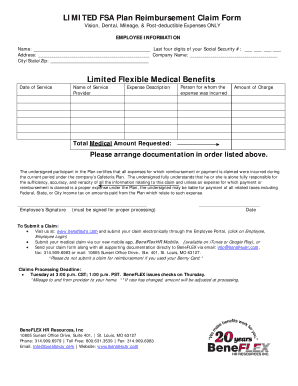

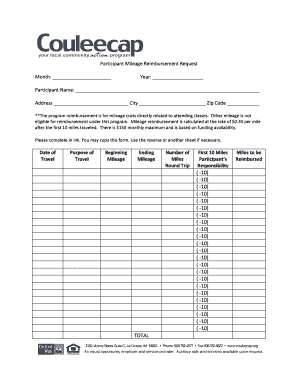

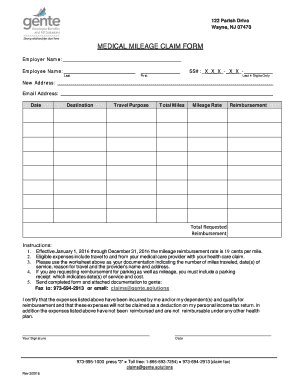

A Mileage Report Form is a document used to record the distance travelled by a vehicle for business or personal purposes. It is commonly used by individuals and organizations to track mileage for reimbursement or tax deduction purposes. This form typically includes information such as the date of travel, starting and ending locations, purpose of the trip, and total miles driven.

What are the types of Mileage Report Form?

There are several types of Mileage Report Forms depending on the specific needs and requirements of the user. Some common types include:

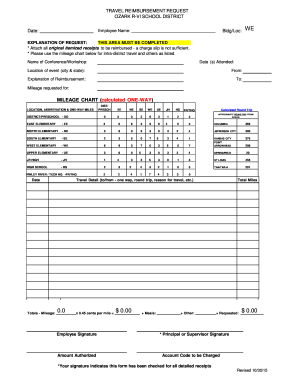

Standard Mileage Report Form: This is the most basic form used to record mileage, capturing essential details such as date, starting and ending locations, and total miles driven.

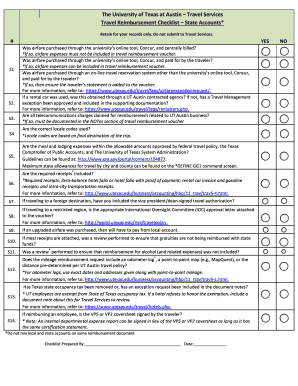

Business Mileage Report Form: Specifically designed for employees or individuals conducting business-related travel, this form often includes additional fields for recording the purpose of the trip and the client or company visited.

Personal Mileage Report Form: Used by individuals to track personal vehicle mileage for tax or personal expense purposes. This form may require additional information such as the reason for personal travel.

Fleet Mileage Report Form: This form is used by companies or organizations with a fleet of vehicles to track and manage their overall mileage and expenses. It often includes fields for multiple vehicles and allows for easier consolidation of data.

How to complete Mileage Report Form

Completing a Mileage Report Form is a straightforward process. Follow these steps:

01

Enter the date of travel in the corresponding field.

02

Fill in the starting and ending locations of your trip.

03

Provide a brief description or purpose of the trip, such as 'meeting with clients' or 'grocery shopping.'

04

Record the total miles driven during the trip.

05

Review the form for accuracy and completeness.

06

Save or submit the form as required by your organization or personal needs.

pdfFiller is an online platform that empowers users to create, edit, and share documents online, including Mileage Report Forms. With its unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently manage your documents and streamline your form-filling processes.