Monthly Cash Flow Plan

What is Monthly Cash Flow Plan?

Monthly Cash Flow Plan is a financial tool that helps individuals track and manage their income and expenses on a monthly basis. It allows you to analyze your cash flow and make informed decisions about your budget and spending.

What are the types of Monthly Cash Flow Plan?

There are two main types of Monthly Cash Flow Plan that you can use:

Simple Monthly Cash Flow Plan: This type of plan is perfect for individuals who want to get a basic understanding of their cash flow. It includes tracking income, expenses, and savings.

Detailed Monthly Cash Flow Plan: This type of plan is more comprehensive and suitable for individuals who want to have a detailed breakdown of their income and expenses. It includes tracking income from multiple sources, categorizing expenses, and analyzing spending patterns.

How to complete Monthly Cash Flow Plan

Completing a Monthly Cash Flow Plan is simple and can be done in a few easy steps:

01

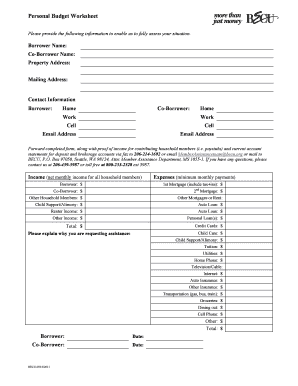

Gather all your financial information, including income sources, monthly bills, and expenses.

02

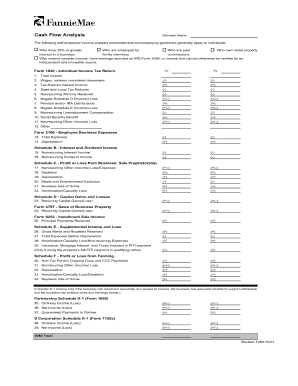

Determine your total monthly income by adding up all the money you receive regularly.

03

List all your monthly bills and expenses, including rent/mortgage, utilities, groceries, transportation, entertainment, and savings.

04

Subtract your total expenses from your total income to calculate your cash flow.

05

Analyze your cash flow to identify areas where you can reduce expenses or increase savings.

06

Make necessary adjustments to your budget and spending habits to achieve your financial goals.

pdfFiller is a powerful online tool that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done efficiently and effectively.

Video Tutorial How to Fill Out Monthly Cash Flow Plan

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a monthly cash flow plan?

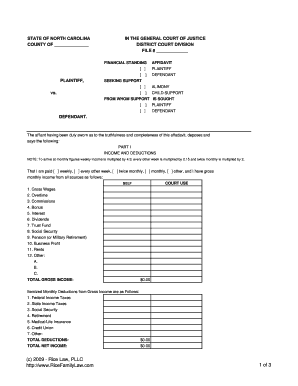

Your Monthly Cash Flow Plan. (BUDGET) A monthly cash flow plan or budget gives you more control over your money and sets you up to achieve short-term and long-term financial goals and dreams. It is important to have a zero based cash flow plan which means your monthly income minus your expenses should equal ZERO.

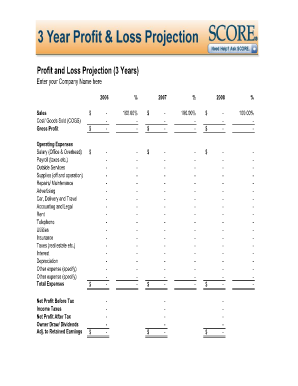

How do you create a monthly cash flow?

Four steps to a simple cash flow forecast Decide how far out you want to plan for. Cash flow planning can cover anything from a few weeks to many months. List all your income. For each week or month in your cash flow forecast, list all the cash you've got coming in. List all your outgoings. Work out your running cash flow.

How do you prepare a cash flow budget?

Add total projected cash outflows for the year and for each period. Add the total outflows for each period to check that they equal the total projected outflows for the year. Subtract total cash outflows from total cash inflows to determine the net cash flow for each period.

What are the 5 steps of budget preparation?

Six steps to budgeting Assess your financial resources. The first step is to calculate how much money you have coming in each month. Determine your expenses. Next you need to determine how you spend your money by reviewing your financial records. Set goals. Create a plan. Pay yourself first. Track your progress.

Why is it important to have a cash flow plan?

Cash flow planning is intended to ensure that a business has enough money set aside to deal with any potential unexpected expenses. Knowing exactly how much money is available is vital in ensuring that your company is both solvent enough to cope with any and all outgoings, while also avoiding a negative cash flow.

What is cash flow budget with example?

A cash flow budget is an estimate of all cash receipts and all cash expenditures that are expected to occur during a certain time period. Estimates can be made monthly, bimonthly, or quarterly, and can include nonfarm income and expenditures as well as farm items.

Related templates