Mortgage Release Satisfaction And Discharge - Page 2

What is mortgage release satisfaction and discharge?

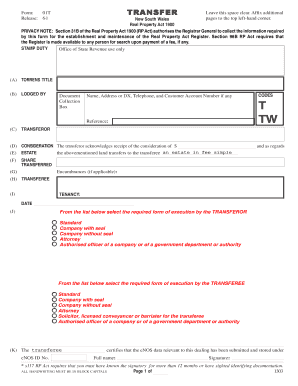

Mortgage release satisfaction and discharge is a legal process that allows homeowners to free themselves from the financial obligations of their mortgage. It is often used when the mortgage has been fully paid off or when the property is being sold. This process ensures that the mortgage is officially released, and the homeowner is no longer responsible for any remaining payments or liens.

What are the types of mortgage release satisfaction and discharge?

There are two main types of mortgage release satisfaction and discharge: voluntary and involuntary. Voluntary release occurs when the homeowner willingly pays off the mortgage or sells the property. Involuntary release happens when the mortgage debt is satisfied through legal proceedings due to foreclosure, bankruptcy, or other circumstances beyond the homeowner's control.

How to complete mortgage release satisfaction and discharge

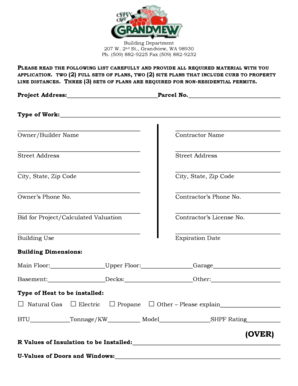

Completing mortgage release satisfaction and discharge involves several steps:

pdfFiller simplifies the process of completing mortgage release satisfaction and discharge forms. With its user-friendly platform, you can easily create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to confidently complete your mortgage release satisfaction and discharge paperwork.