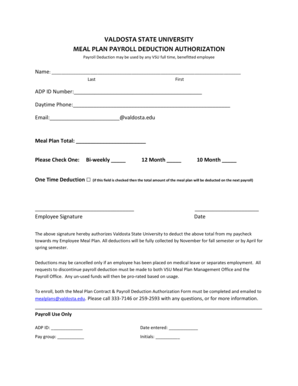

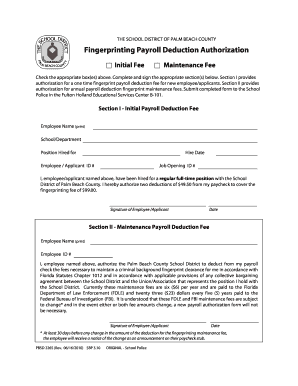

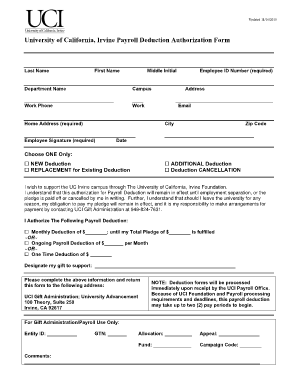

One Time Payroll Deduction Authorization Form

What is one time payroll deduction authorization form?

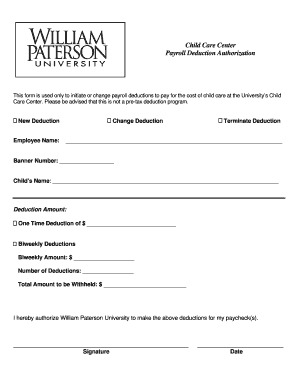

A one time payroll deduction authorization form is a document that allows an employee to authorize a specific deduction or amount to be taken from their paycheck for a one-time occurrence.

What are the types of one time payroll deduction authorization form?

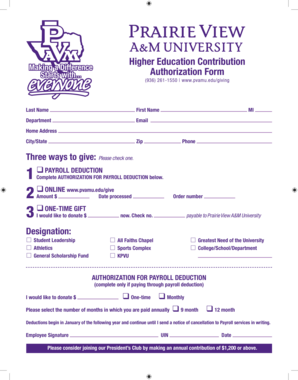

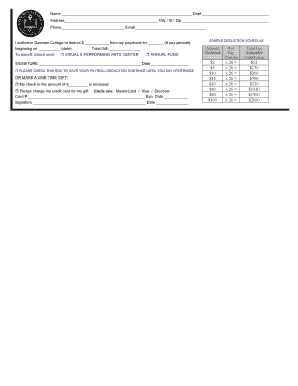

There are several types of one time payroll deduction authorization forms depending on the purpose of the deduction. Some common types include:

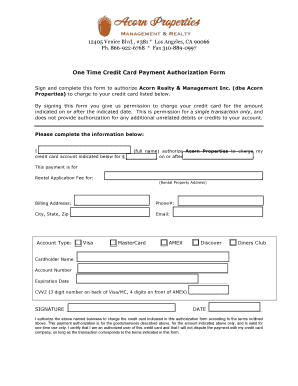

Medical expenses

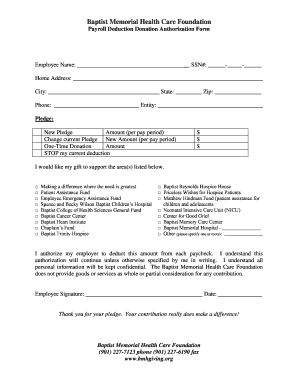

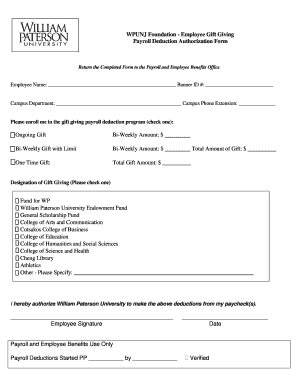

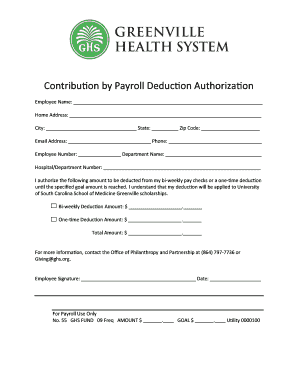

Charitable donations

Loan repayments

How to complete one time payroll deduction authorization form

To complete a one time payroll deduction authorization form, follow these steps:

01

Fill in your personal information, including name, employee ID, and contact details.

02

Specify the type of deduction and the amount to be deducted.

03

Sign and date the form to authorize the deduction.

04

Submit the completed form to your employer.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

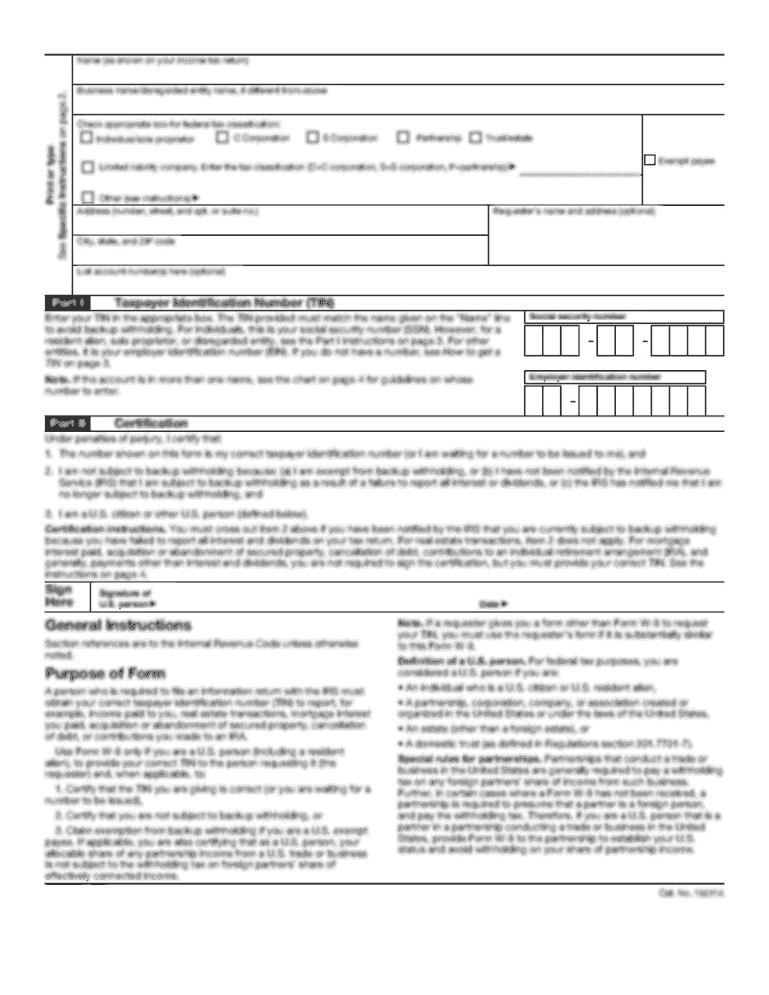

How do I calculate deductions on payroll?

Federal tax withholding calculations 2021 Federal income tax withholding calculation: Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Subtract $12,900 for Married, otherwise subtract $8,600 for Single or Head of Household from your computed annual wage.

What is Authorised deduction?

Authorized Deduction means those items set forth in each Application, or other authorization, that a Settlement Products Client authorizes the Originator, or a servicer on behalf of the Originator, to deduct from its Deposit Account.

What is payroll authorization?

Payroll Authorization means a Participant's written authorization to withhold from his wages, specified percentages which shall be as either a Salary Deferral Contribution or Matched Voluntary Contribution or Nonmatched Voluntary Contribution contributed to this Plan on his behalf. Sample 1Sample 2.

How do I do payroll deductions?

How to calculate payroll deductions Adjust gross pay by withholding pre-tax contributions to health insurance, 401(k) retirement plans and other voluntary benefits. Refer to the employee's Form W-4 and the IRS tax tables for that year to calculate and deduct federal income tax.

What are three examples of payroll deductions?

Examples of payroll deductions include federal, state, and local taxes, health insurance premiums, and job-related expenses.

How do you properly do payroll?

How to calculate and do payroll on your own Step 1 – Calculate hours worked and gross pay. Step 2 – Process payroll deductions. Step 3 – Calculate net pay and pay employees. Step 4 – File tax reports. Step 5 – Document and store payroll records. Step 6 – Report new hires.

Related templates