Opening Day Balance Sheet Score

What is opening day balance sheet score?

The opening day balance sheet score is a financial metric that evaluates the financial health and stability of a company at the beginning of a specific period. It takes into account the company's assets, liabilities, and equity to provide an overview of its financial position.

What are the types of opening day balance sheet score?

There are two main types of opening day balance sheet scores:

Current Ratio Score: This score compares the company's current assets to its current liabilities to assess its liquidity and ability to meet short-term obligations.

Debt-to-Equity Ratio Score: This score measures the proportion of debt relative to equity in a company, indicating its financial leverage and risk level.

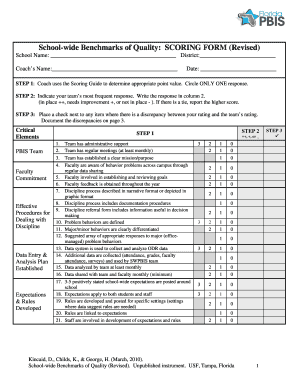

How to complete opening day balance sheet score

To complete the opening day balance sheet score, follow these steps:

01

Gather the financial statements for the specific period, including the balance sheet.

02

Calculate the current ratio by dividing current assets by current liabilities.

03

Calculate the debt-to-equity ratio by dividing total debt by total equity.

By completing these calculations, you can obtain the opening day balance sheet score for a company and gain insights into its financial position.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I make an opening balance sheet in Excel?

How to create a balance sheet in Excel Format your worksheet. You can create a balance sheet in Excel by first creating a title section and labels for your worksheet. Enter dollar amounts. Leave a column of space between your asset labels and the location in which you want to enter the dollar amounts. Add totals.

How do you record opening balance in accounting?

To enter your opening balances, you need a list of your outstanding customer and vendor invoices and credit notes, your closing trial balance from your previous accounting period, and your bank statements. You also need a list of the unrepresented bank items from your previous accounting system.

How do you enter an opening balance in Excel?

0:11 2:21 How to enter opening balance in Excel checkbook register software YouTube Start of suggested clip End of suggested clip Click ok and then going to go to the register. And then you're going to enter that opening balanceMoreClick ok and then going to go to the register. And then you're going to enter that opening balance adjustment transaction. So enter your date.

What are the opening balances in a balance sheet?

The opening balance is the amount of funds in a company's account at the beginning of a new financial period. It is the first entry in the accounts, either when a company is first starting up its accounts or after a year-end.

How do you prepare an opening balance sheet?

How to Prepare a Basic Balance Sheet Determine the Reporting Date and Period. Identify Your Assets. Identify Your Liabilities. Calculate Shareholders' Equity. Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.

What should be included in the opening balance sheet?

Your opening balance sheet will list all of your company assets and liabilities. In accordance with Section 242 of the Handelsgesetzbuch (HGB), if your company is required to submit a balance sheet, it must be done when you have founded your company and at the beginning of the financial year.

Related templates