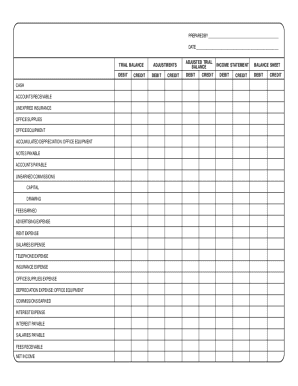

Opening Day Balance Sheet Template

What is Opening Day Balance Sheet Template?

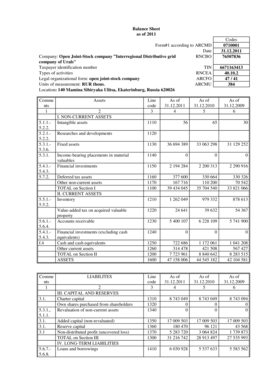

An Opening Day Balance Sheet Template is a document used to assess the financial position of a company at the beginning of a new fiscal year. It provides a snapshot of the company's assets, liabilities, and equity on the first day of the accounting period.

What are the types of Opening Day Balance Sheet Template?

There are several types of Opening Day Balance Sheet Templates available, including:

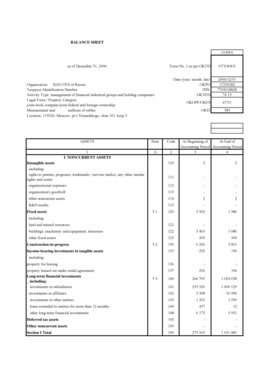

Simple Opening Day Balance Sheet Template

Detailed Opening Day Balance Sheet Template

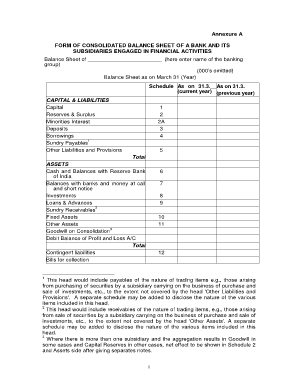

Consolidated Opening Day Balance Sheet Template

How to complete Opening Day Balance Sheet Template

Completing an Opening Day Balance Sheet Template is a straightforward process. Here are the steps to follow:

01

Gather all necessary financial documents, such as bank statements, invoices, and payroll records.

02

List all the company's assets, including cash, accounts receivable, inventory, and property.

03

Record all liabilities, such as loans, accounts payable, and outstanding debts.

04

Calculate the company's equity by subtracting liabilities from assets.

05

Review and double-check the accuracy of all the information entered.

06

Save and store the completed Opening Day Balance Sheet Template for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What should be included in the opening balance sheet?

Your opening balance sheet will list all of your company assets and liabilities. In accordance with Section 242 of the Handelsgesetzbuch (HGB), if your company is required to submit a balance sheet, it must be done when you have founded your company and at the beginning of the financial year.

What is a opening day balance sheet?

An “opening day balance sheet” lists assets -- such as cash and property -- and liabilities -- or debts and expenses. It finds how much a business is worth by subtracting liabilities from assets. This shows “net worth,” also known as “owner's equity.”

How do you calculate opening and closing balances in Excel?

The closing balance is the opening balance plus the principal payment being made, which is =E29+E32. The opening balance for period 2 is the closing balance for period 1, which is =E33. 4. Copy all formulas from cell E29 to E33 to the next column, then copy everything to the right.

What is opening and closing balance sheet?

Whatever the number is at the end of the month after all your sales have been recorded and all your payments have been made, that is your closing balance. You will then transfer that closing balance to next month's balance sheet, which will become the opening balance for that period.

How do you make an opening day on a balance sheet?

How to Create an Opening Balance Sheet for a New Business Write out every asset of the company and how much each asset is worth. Write out any debt your company currently has in relation to the assets. Subtract your total liabilities from your assets to calculate your owner's equity.

How do I make an opening balance sheet in Excel?

How to create a balance sheet in Excel Format your worksheet. You can create a balance sheet in Excel by first creating a title section and labels for your worksheet. Enter dollar amounts. Leave a column of space between your asset labels and the location in which you want to enter the dollar amounts. Add totals.

Related templates