Pan Card Correction Form Pdf 2016

What is pan card correction form pdf 2016?

The pan card correction form pdf 2016 is a document used for making corrections or updates to an existing PAN card. It is specifically designed for the year 2016 and is in a portable document format (PDF) that can be easily filled out and submitted electronically.

What are the types of pan card correction form pdf 2016?

There are two main types of pan card correction form pdf 2016: 1. Form for correction in PAN card details: This form is used when there are mistakes or changes needed in the personal details, such as name, address, or date of birth, associated with the PAN card. 2. Form for reissue of PAN card: This form is used when there is a need for a new PAN card due to loss, theft, or damage of the existing card.

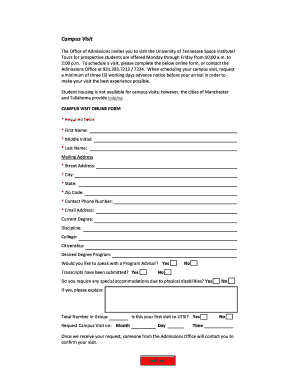

How to complete pan card correction form pdf 2016

To complete the pan card correction form pdf 2016, follow these steps: 1. Download the form from the official website of the Income Tax Department. 2. Fill in the necessary personal details correctly, such as name, address, and date of birth. 3. Provide accurate information regarding the corrections or updates required. 4. Attach supporting documents, if required, as mentioned in the form. 5. Review the filled form to ensure all information is correctly entered. 6. Sign the form and submit it either online or offline, as per the instructions provided.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.