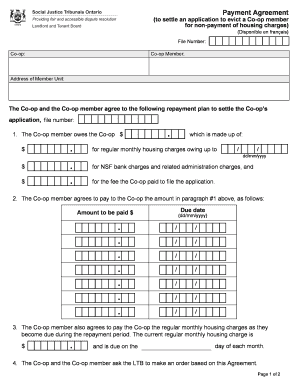

Payment Agreement Contract

What is Payment Agreement Contract?

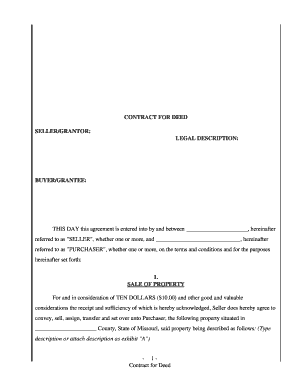

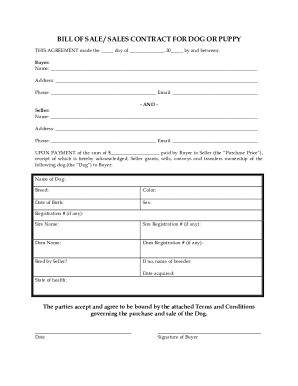

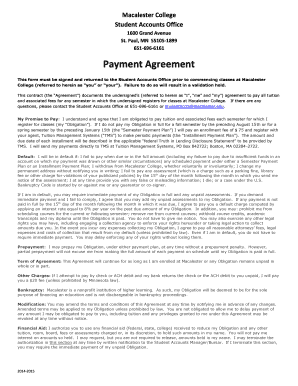

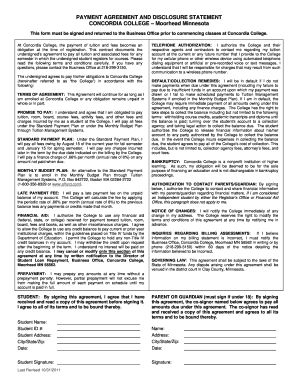

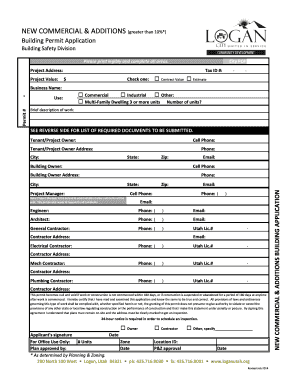

A Payment Agreement Contract is a legally binding document that outlines the terms and conditions of a financial arrangement between two parties. It serves as a written agreement to ensure that all parties involved are aware of their obligations and responsibilities regarding the payment terms.

What are the types of Payment Agreement Contract?

Payment Agreement Contracts can vary depending on the specific arrangement and purpose. Some common types of Payment Agreement Contracts include:

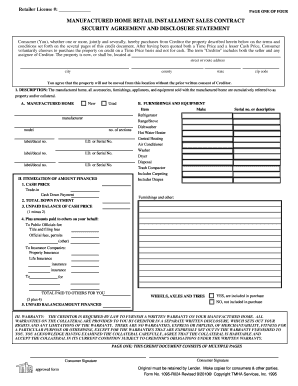

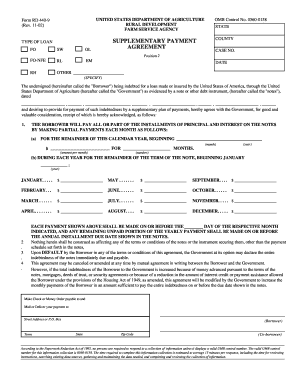

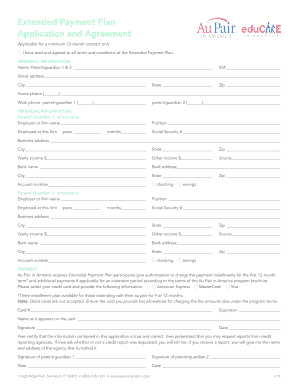

Installment Payment Agreement: This type of agreement specifies the payment schedule and amounts for periodic installments.

Loan Payment Agreement: This agreement outlines the terms and conditions for repaying a loan, including interest rates and payment due dates.

Lease Payment Agreement: A lease payment agreement governs the payment terms for leasing or renting a property or equipment.

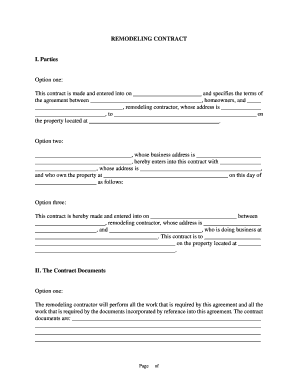

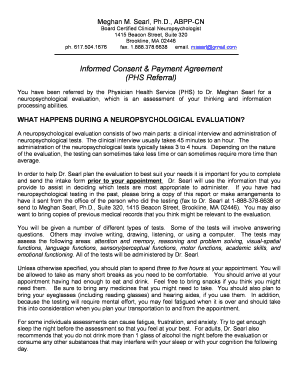

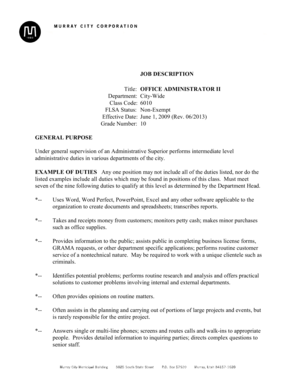

Service Payment Agreement: This type of agreement is used when paying for specific services rendered, such as consulting or professional services.

How to complete Payment Agreement Contract

Completing a Payment Agreement Contract is a straightforward process. Here are the steps to follow:

01

Start by entering the names and contact information of all parties involved.

02

Specify the details of the payment arrangement, including payment amounts, due dates, and any applicable interest rates.

03

Include any additional terms or conditions that both parties agree to, such as late fees or penalty charges for missed payments.

04

Review the contract thoroughly to ensure all information is accurate and reflects the intended agreement.

05

Finally, sign and date the contract to make it legally binding. It is recommended to have all parties sign the document to acknowledge their agreement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Payment Agreement Contract

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write a simple payment agreement?

How to Write a Simple Payment Contract Contract Identification. You will need to identify what the payment agreement is being drafted for. Consenting Parties. The next section will need to include detailed information about the parties involved in the contract. Agreement. Date. Signature.

What is a payment plan agreement?

A payment plan agreement, also known as an installment agreement, is a written legal document that allows one party to make smaller payments over time to payoff a larger debt.

How do I write a letter of agreement between two parties for payment?

How to write a letter of agreement Title the document. Add the title at the top of the document. List your personal information. Include the date. Add the recipient's personal information. Address the recipient. Write an introduction paragraph. Write your body. Conclude the letter.

How do you write a payment plan for a proposal?

What does it Include? Basic details of dealer like name, address, phone number, account number. Basic details of a buyer like a name, address, phone number, and account number. Request date. Details of the request like when you are proposing to pay or get paid in parts of every month.

How do I write a payment agreement letter?

Components of a Payment Agreement Template Acknowledgment of the Deficiency. The complete, legal names of the lender and the borrower. The total amount of money which was loaned. The terms of payment. When the payments will be made and how they will be made. The date when the loan will be fully paid.

How do you write a payment agreement between two parties?

A payment agreement should always be in writing and include information regarding the type of payment to be given, when it should be given, how it will be paid, and what happens should the borrower default on the terms specified in the agreement. This type of agreement can be found for any loan contract.

Related templates