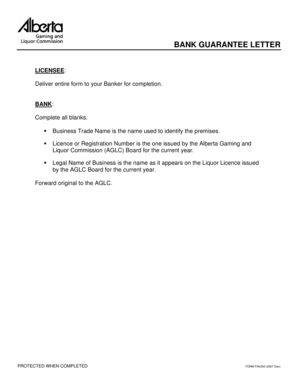

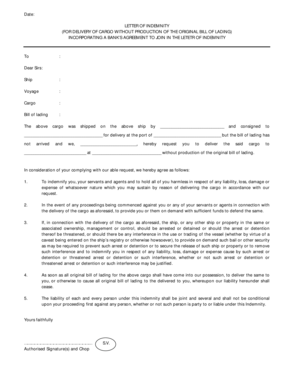

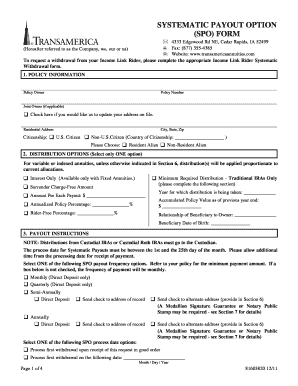

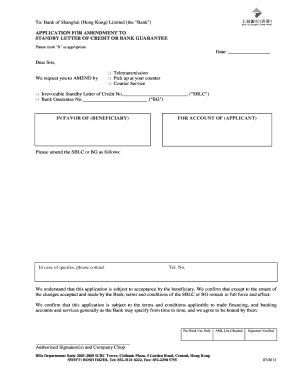

Payment Guarantee Letter Template

What is payment guarantee letter template?

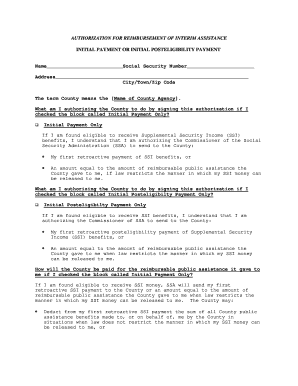

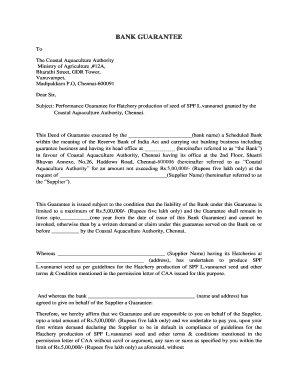

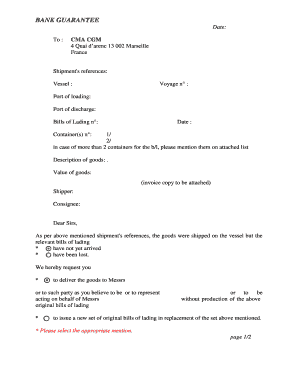

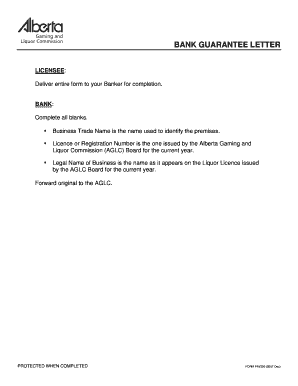

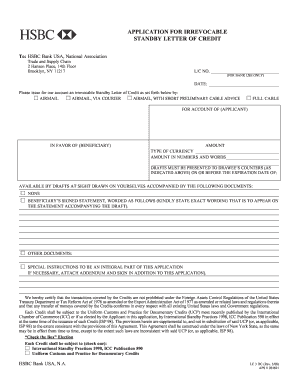

A payment guarantee letter template is a pre-designed document that is used to provide assurance to the recipient that payment will be made as promised. It outlines the terms and conditions of the guarantee and serves as a legally binding agreement between the parties involved.

What are the types of payment guarantee letter template?

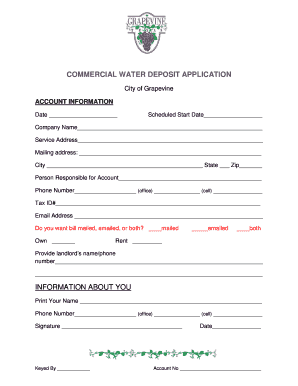

There are various types of payment guarantee letter templates available. Some common types include:

How to complete payment guarantee letter template

Completing a payment guarantee letter template is a simple process. Follow these steps to fill out the template effectively:

pdfFiller empowers users to create, edit, and share documents online, including payment guarantee letter templates. With unlimited fillable templates and powerful editing tools, pdfFiller is the all-in-one solution for getting your documents done efficiently and professionally.