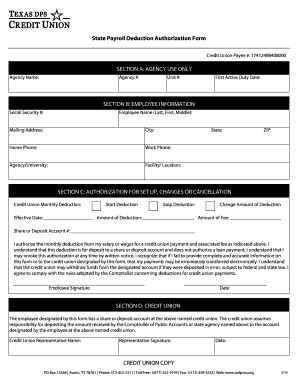

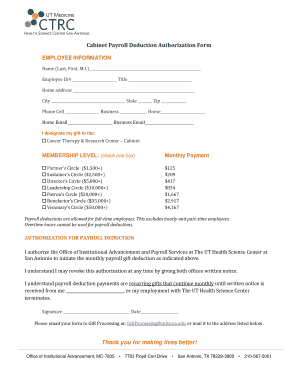

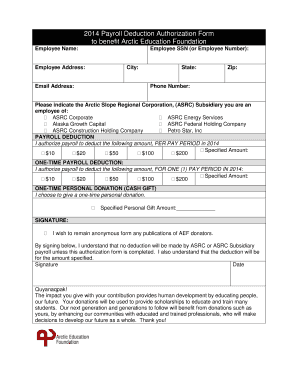

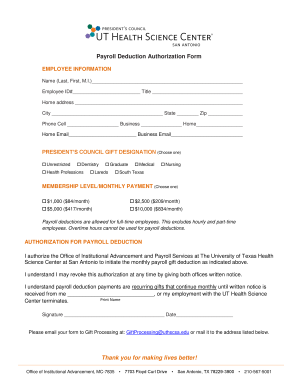

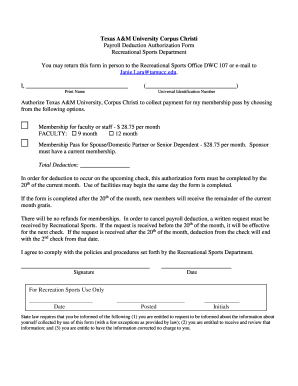

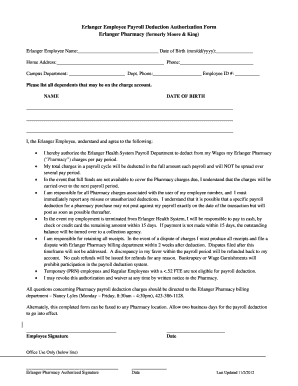

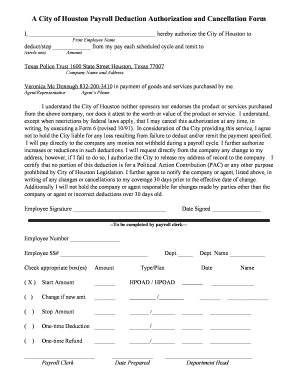

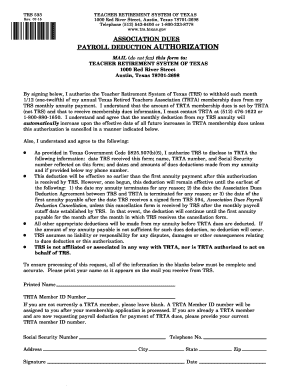

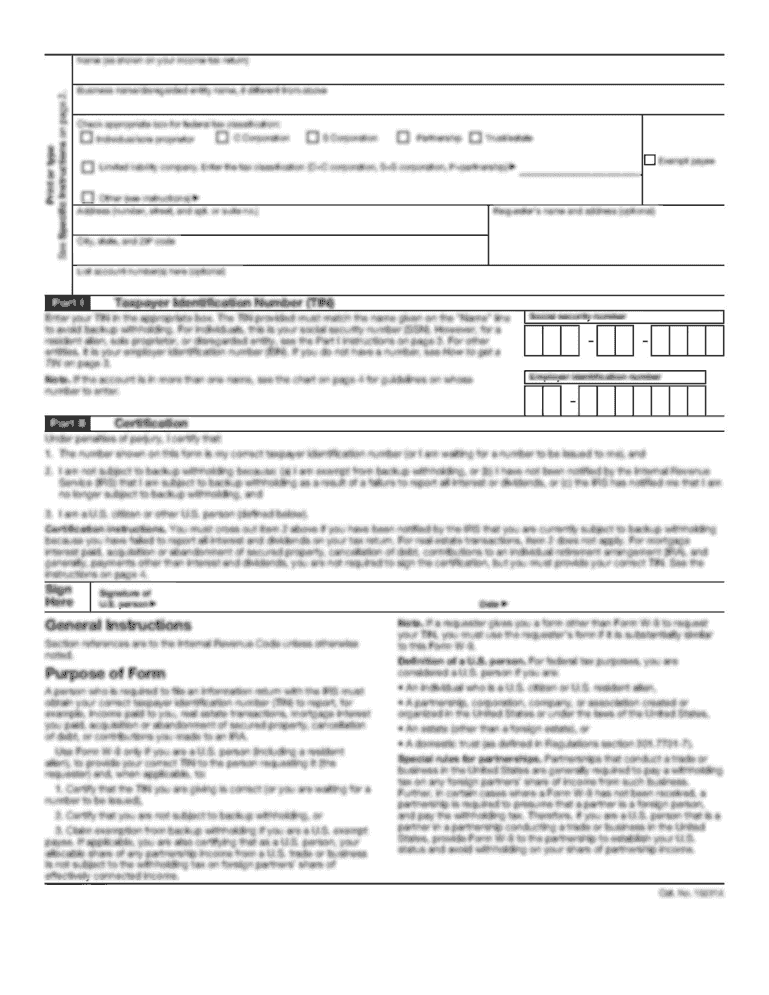

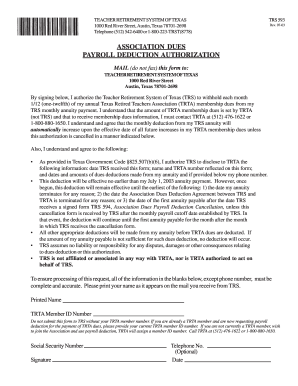

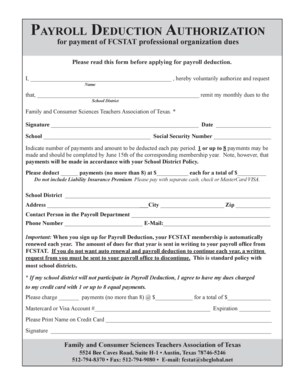

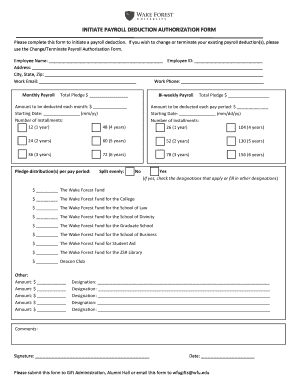

Payroll Deduction Authorization Form Texas

What is payroll deduction authorization form Texas?

A payroll deduction authorization form Texas is a legal document that allows employers to deduct certain amounts from an employee's paycheck for specified purposes. This form is used to authorize deductions such as taxes, healthcare premiums, retirement contributions, and other voluntary deductions.

What are the types of payroll deduction authorization form Texas?

There are several types of payroll deduction authorization form Texas, including:

Standard payroll deduction authorization form

Healthcare deduction authorization form

Retirement contribution authorization form

Child support deduction authorization form

Charitable donation deduction authorization form

How to complete payroll deduction authorization form Texas?

To complete a payroll deduction authorization form Texas, follow these steps:

01

Fill in personal information such as name, address, and social security number.

02

Specify the type of deduction or deductions you are authorizing.

03

Indicate the amount or percentage of the deduction.

04

Include any additional instructions or information.

05

Sign and date the form to validate your authorization.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out payroll deduction authorization form texas

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is payroll authorization?

Payroll Authorization means a Participant's written authorization to withhold from his wages, specified percentages which shall be as either a Salary Deferral Contribution or Matched Voluntary Contribution or Nonmatched Voluntary Contribution contributed to this Plan on his behalf. Sample 1Sample 2.

Can an employer deduct wages without consent?

Normally your employer needs your written consent, and the deduction must be both reasonable and for a lawful purpose. This includes if your employment agreement contains a general deductions clause, but in this case your employer must consult with you before they make a specific deduction.

Can an employer deduct wages for mistakes Ontario?

If an employee is mistakenly overpaid, in Ontario that can be deducted without authorization. as long as the employer acts in a reasonably expeditious manner, so they act as soon as they find out.

Can an employer deduct wages for faulty work?

Here are four common myths about wage deductions: FACT: Costs of faulty work or damage, such as broken tools or customers' “dine and dash” can't be deducted.

Can you deduct pay from a salaried employee?

Salary Expenses If you hire someone else to help you with your work, you can deduct the salary you paid as long as your T2200 specifies the need for such costs. You will have to withhold tax and remit EI and CPP (or QPP), and file a T4 to CRA (and RL-1 for Quebec residents).

Can you deduct money from an employee's paycheck in Texas?

Under section 61.018 of the Texas Payday Law, all deductions, other than payroll taxes, court-ordered garnishments, and other deductions either required by law or specifically authorized by statute, must be both lawful and specifically authorized in writing by the employee.

Related templates