Payroll Templates

Video Tutorial How to Fill Out Payroll Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

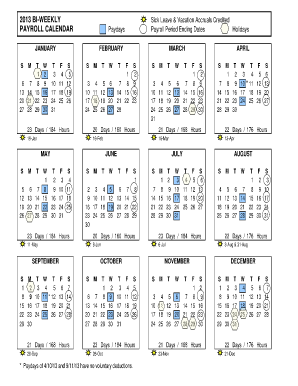

How do I create a payroll schedule in Excel?

Go to File > New and choose Available Templates. From there, look for an option for Schedules. Pick Business Schedules and select a template with a format and style that works for your company's employee calendar. Alternatively, you can type Calendar in the online search box and click Enter to search.

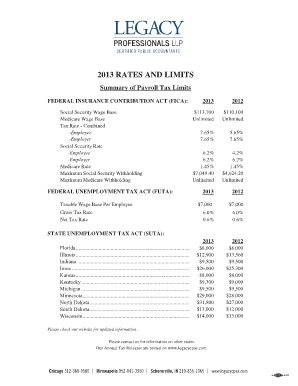

When setting up payroll What should you do first?

Here's what you'll need to take care of before setting up payroll. Step 1: Get an EIN. Step 2: Get a local or state business ID (if necessary) Step 3: Nail down your team's info. Step 4: Classify your employees. Now you're ready to dig in. Step 5: Choose a pay period. Step 6: Pick a payroll system.

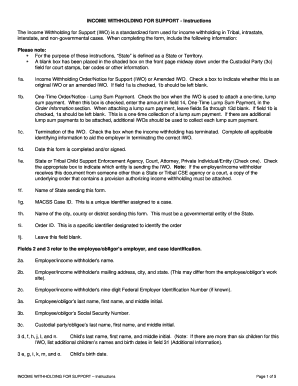

Is there a payroll template in Excel?

Excel payroll templates help you to quickly calculate your employees' income, withholdings, and payroll taxes. Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees.

How do I start doing payroll?

How to set up payroll Step 1 – Apply for an EIN. Step 2 – Obtain your local or state business ID. Step 3 – Collect employee documents. Step 4 – Choose pay periods. Step 5 – Purchase workers' compensation insurance. Step 6 – Offer optional benefits to employees. Step 7 – Open a payroll bank account.

How do I create a payroll template?

How to Do Payroll in Excel in 7 Steps + Free Template 1 Review & Edit Payroll Excel Template. 2 Set Up Employee Payroll Information. 3 Set Up Employer Payroll Tax Information. 4 Enter Hours Worked & Other Income Details. 5 Review Automatic Payroll Calculations. 6 Pay Your Employees. 7 Review Year-to-Date Payroll Information.

How do I create a payroll formula in Excel?

Gross Pay is nothing but the sum of the product of Pay/Hour. Total Worked Hours and Overtime/Hour, Total Overtime Hours. (Pay/Hour * Total Hours Worked) + (Overtime/Hour * Total Overtime Hours). The payroll sheet can be formulated under cell F4 as =(B2*C2)+(D2*E2). It's a simple formula anyway.

Related templates