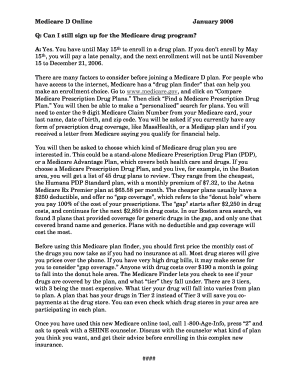

Penalties For Not Signing Up For Medicare

What is penalties for not signing up for medicare?

If you are eligible for Medicare but choose not to enroll, you may face penalties. These penalties can have financial implications and may affect your healthcare coverage. It is important to understand the potential consequences of not signing up for Medicare in order to make informed decisions about your healthcare.

What are the types of penalties for not signing up for medicare?

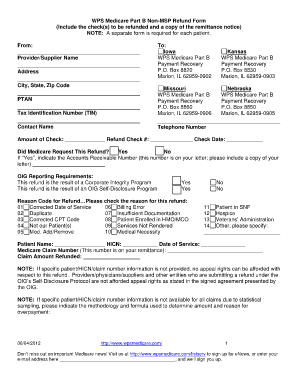

There are different types of penalties that you may incur for not signing up for Medicare. These include the late enrollment penalty, the monthly premium penalty, and the gap in coverage penalty. Each penalty is designed to encourage timely enrollment and ensure that individuals have continuous healthcare coverage.

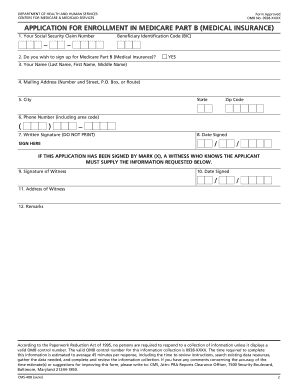

How to complete penalties for not signing up for medicare

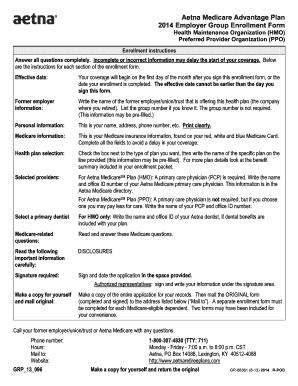

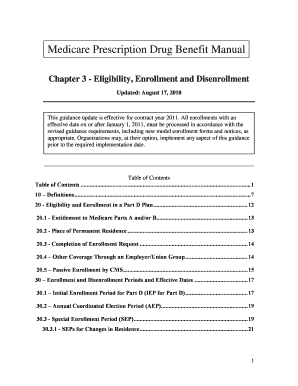

To avoid penalties for not signing up for Medicare, here are some steps you can take: 1. Understand your Medicare eligibility: Determine when you are first eligible for Medicare and what parts you should enroll in. 2. Enroll during your Initial Enrollment Period (IEP): This is typically a seven-month window around your 65th birthday when you can enroll in Medicare without penalties. 3. Consider your healthcare needs: Evaluate your healthcare needs and the available Medicare plans to choose the best coverage options for you. 4. Plan ahead: Start the enrollment process early to ensure you don't miss any deadlines or incur any penalties. 5. Seek help if needed: If you are unsure about the Medicare enrollment process or need assistance, reach out to resources like the Medicare website or a local insurance agent.

By following these steps and being proactive about your Medicare enrollment, you can avoid penalties and ensure you have the healthcare coverage you need. Remember, pdfFiller empowers users to create, edit, and share documents online, making it easier for you to manage paperwork related to your Medicare enrollment. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to confidently complete your Medicare enrollment forms and stay on top of your healthcare paperwork.