Personal Financial Statement Definition

What is personal financial statement definition?

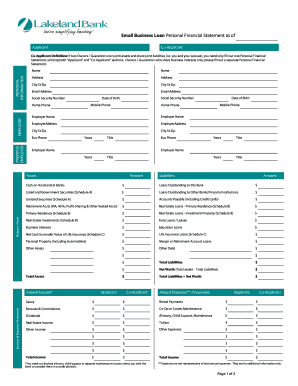

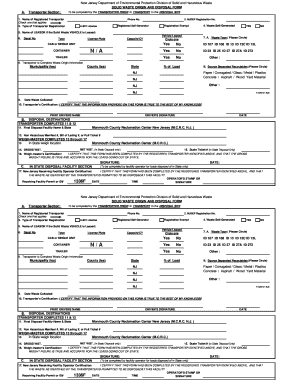

A personal financial statement is a document that provides an overview of an individual's financial situation. It includes information about their assets, liabilities, income, and expenses. The purpose of a personal financial statement is to assess an individual's net worth and financial health.

What are the types of personal financial statement definition?

There are several types of personal financial statements that individuals can use to evaluate their finances. These include:

Balance sheet: This type of financial statement provides a snapshot of an individual's assets, liabilities, and net worth.

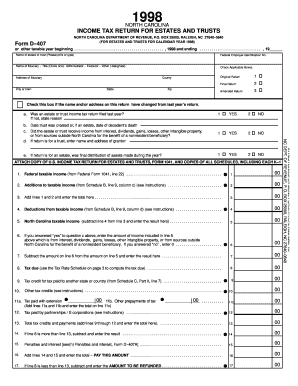

Income statement: Also known as a profit and loss statement, it shows an individual's income and expenses over a specific period of time.

Cash flow statement: This statement tracks the flow of cash into and out of an individual's accounts, providing insights into their liquidity and cash management.

Budget: While not a traditional financial statement, a budget helps individuals plan and manage their income and expenses effectively.

How to complete personal financial statement definition

Completing a personal financial statement is a straightforward process. Here are the steps to follow:

01

Gather necessary financial documents, including bank statements, investment statements, pay stubs, and bills.

02

List all your assets, such as cash, investments, real estate, vehicles, and personal property.

03

Record all liabilities, such as mortgages, loans, credit card debt, and other outstanding debts.

04

Calculate your net worth by subtracting your total liabilities from your total assets.

05

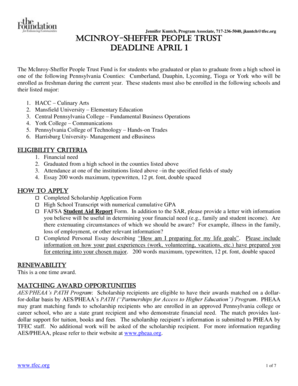

Document your income from various sources, including wages, investments, and any side businesses.

06

Track your expenses by categorizing them into fixed expenses (e.g., rent, utilities) and variable expenses (e.g., groceries, entertainment).

07

Calculate your cash flow by subtracting your expenses from your income.

08

Review and analyze your personal financial statement for insights into your financial situation and make any necessary adjustments.

09

Discuss your personal financial statement with a financial advisor or accountant for professional guidance if needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

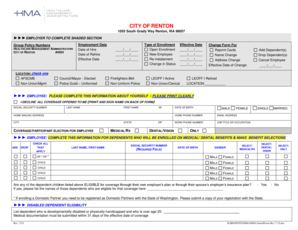

How do I fill out a personal financial statement SBA?

How to fill out SBA Form 413 Step 1: Fill in basic business information. Step 2: Add information about your assets. Step 3: Add information about your liabilities. Step 4: Complete section 1 for your source of income and contingent liabilities. Step 5: Complete section 2 with your notes payable to banks and others.

What items should be identified on a personal financial statement?

A personal financial statement is a snapshot of your personal financial position at a specific point in time. It lists your assets (what you own), your liabilities (what you owe), and your net worth. To get your net worth, subtract liabilities from assets.

How do I prepare an income statement for myself?

How to Write an Income Statement Pick a Reporting Period. Generate a Trial Balance Report. Calculate Your Revenue. Determine Cost of Goods Sold. Calculate the Gross Margin. Include Operating Expenses. Calculate Your Income. Include Income Taxes.

What two things should be on a personal financial statement?

Key Takeaways. A personal financial statement lists all assets and liabilities of an individual or couple. An individual's net worth is determined by subtracting their liabilities from their assets—a positive net worth shows more assets than liabilities.

How do you write a personal financial statement?

To create a personal financial statement, follow these simple steps: Create a spreadsheet that has a section for assets and one for liabilities. List your assets and their worth. List every liability as well as its worth. Determine the total of both assets and liabilities. Determine your net worth.

What are examples of personal financial information?

Personal financial information means an individual's personal credit, charge or debit card information. bank account information. band, credit or financial statements. account or PIN numbers and other information relating to an individual's personal finances.

Related templates