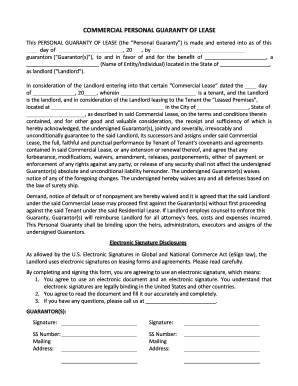

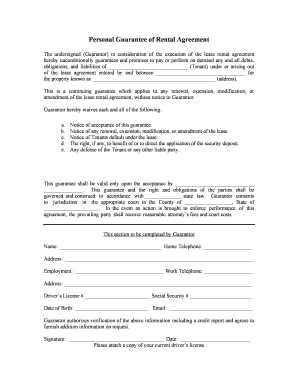

Personal Guarantee Form Lease

What is personal guarantee form lease?

A personal guarantee form lease is a legal document that outlines an individual's commitment to take responsibility for the financial obligations of a lease. By signing this agreement, the guarantor agrees to pay any outstanding rent or damages if the primary tenant fails to do so.

What are the types of personal guarantee form lease?

There are two common types of personal guarantee form lease:

Individual Guarantee: In this type, a single person signs the agreement and assumes the responsibility for the lease.

Joint and Several Guarantee: This type involves multiple guarantors who collectively become responsible for the lease. They can be held accountable for the whole lease or a portion of it.

How to complete personal guarantee form lease

To complete a personal guarantee form lease, follow these simple steps:

01

Fill in the names and contact information of all parties involved; the guarantor, the tenant, and the landlord.

02

Clearly state the terms of the lease, including the duration, the rent amount, and any additional provisions.

03

Specify the responsibilities and obligations of the guarantor, emphasizing their commitment to fulfilling them if required.

04

Review the document carefully to ensure all information is accurate and complete.

05

Sign the form and have all parties involved sign it as well.

06

Make copies of the signed document for each party for their records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out personal guarantee form lease

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is an example of a guarantor?

A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead. If your guarantor doesn't pay, your landlord can take them to court.

How do you avoid personal guarantee on a commercial lease?

Show proof of consistent revenues and profits (P&L statements, balance sheets, etc) Ask for an amendment to the lease after 12-24 months. Ask for the guarantee to expire after 12-24 months as long as you have paid rent payments on time. Try to renegotiate the guarantee terms.

How do you write a guarantor letter?

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.

What is a personal guarantee in real estate?

A personal guarantee pledges the private assets of an individual borrower to secure a commercial mortgage. This unsecured written promise is not tied to a specific asset, such as a house, so any part of the borrower's assets can be used to repay the debt.

How can I write a guarantor letter to a company?

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.

What does a personal guarantee mean in a lease?

A personal guarantee puts the tenant's own assets — such as real estate, savings, or other valuables — on the line should their business not be in a position to pay rent or other lease obligations.

Related templates