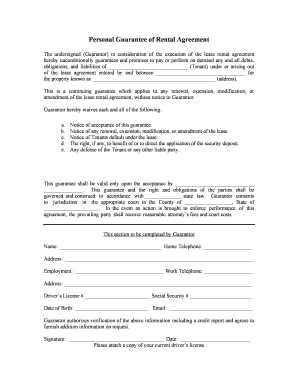

What is Personal Guarantee Form?

A Personal Guarantee Form is a legal document that outlines the obligations and responsibilities of an individual who agrees to personally guarantee the repayment of a loan or debt on behalf of a business or another person. By signing this form, the guarantor accepts full liability for the debt in case the borrower or debtor is unable to fulfill their obligations.

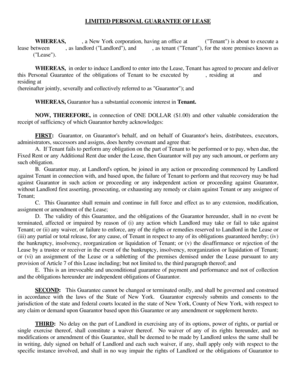

What are the types of Personal Guarantee Form?

There are several types of Personal Guarantee Forms depending on the specific circumstances and agreements. Some common types include:

Unlimited Personal Guarantee: In this type, the guarantor agrees to be liable for the entire debt amount without any limitations.

Limited Personal Guarantee: This type sets a maximum liability limit for the guarantor, beyond which they are not responsible for the debt.

Continuing Personal Guarantee: With this type, the guarantor's liability continues even after certain events, such as the sale or transfer of ownership of the business.

Joint and Several Guarantee: In this type, multiple guarantors share the liability jointly and individually, meaning each guarantor can be held responsible for the entire debt.

Conditional Guarantee: This type of guarantee becomes effective only under specific conditions as specified in the agreement.

How to complete Personal Guarantee Form

Completing a Personal Guarantee Form can be done by following these steps:

01

Download a Personal Guarantee Form from a reliable source or use an online platform like pdfFiller to access ready-to-use templates.

02

Read the form carefully and understand all the terms and conditions, as well as the extent of your liability.

03

Fill in the necessary personal information, such as your name, address, and contact details.

04

Provide details about the borrower or debtor, including their name and the purpose of the loan or debt.

05

Specify the amount of the debt or loan and any additional terms or conditions.

06

Review the completed form for accuracy and make any necessary corrections.

07

Sign the form and have it witnessed or notarized, if required.

08

Keep a copy for your records and provide the original form to the relevant parties.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.